France's CAC and Spain's Ibex the weakest

The European major indices have modest changes on the day with the France's CAC and Spain's Ibex the weakest. The provisional closes are showing:

- German DAX, flat

- France's CAC, -0.3%

- UK's FTSE 100, up 0.1%

- Spain's Ibex, -0.3%

- Italy's FTSE MIB, flat

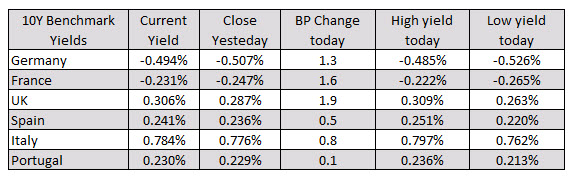

In the European debt market, the yields in the benchmark 10 year notes are marginally higher. UK yields moved the most with a 1.9 basis point gain.

A snapshot of the forex market as London/European traders look to exit shows the AUD is the strongest and the JPY is the weakest. That was the order at the start of the NY session. However, each have increased their relative advantages. The GBP was lower at the start of the New York session, but with all the Brexit chatter from EU and UK officials, the GBP has moved higher in the NY session. The USD has weakened in the the NY session with the greenback losing ground vs. both the GBP and the AUD over the last 4 or so hours.

In other markets as London/European traders look to exit, the US stocks are trading near highs:

- The Dow is up 1.57%

- The NASDAQ is up 1.34% and

- The S&P index is up 1.45%.

The Dow has erased the losses from yesterday. The S&P has nearly erased the declines.

- Spot gold is trading up $9.60 or 0.52% at $1887.87. That is not that far off the early New York levels

- Spot silver is up $0.75 or 3.27% at $23.82

- WTI crude oil futures are trading down $1.10 or -2.7% at $39.56. Crude oil inventory data today showed a build of 0.5M barrels vs. expectations of a draw down of -1.2M

In the US debt market, yields are moving higher ahead of the 10 year note auction at 1 PM ET

- 2 year 0.150%, +0.4 basis points

- 5 year 0.335%, +2.3 basis points

- 10 year 0.770%, +3.5 basis points

- 30 year 1.565%, +2.9 basis points