The EURUSD surged higher late yesterday on the backs of more cautious Fed official comments (and perhaps holiday like illiquidity) .

Today, it was the EURUSD time to take back the focus when Industrial Production and ZEW Investor sentiment showed weakness, and the EURUSD responded accordingly by falling sharply (click on images below for the PDF of the trends for each). The trading waters are rough out there. The boat is moving higher and then lower, and higher and then lower

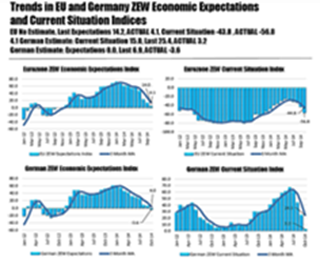

EU and German ZEW show further falls

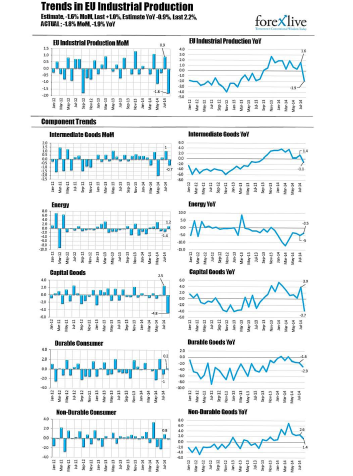

Industrial Production dips in the EU

In the US, the NFIB Small Business Index came in a touch worse than expectations at 95.3 vs estimate of 95.8. However, at 95.3 is still is at the 3rd highest level since October 2007. There are no further economic releases in the US today.

Nevertheless, with the Fed pouring cold water on the dollar rally last week (FOMC meeting minutes and subsequent worry comments), get used to the ups and downs. Overall, the EU remains more vulnerable, but the S&P falling below the 200 day MA, ISIS, Ebola, earnings season just starting and worries the impact of the dollar on earnings, the fickle economy in the US can dip (or survey data should at least get worse – one might think). There is nothing like FEAR.

From a technical perspective, the EURUSD peaked above the lows from 2013 which came in at 1.2746-57 (the high extended up to 1.2766) and fell below the 100 hour MA (blue line) at 1.2690, and the 200 hour MA (green line in the chart below) at the 1.2650 level. The low extended to 1.26387. The midpoint of the October trading range comes in at the 1.2645 and the last two hourly bars seem to be finding some support from that level.

The high to low trading range for the pair is at 129 pips as NY traders enter for the day. That is above the 100 pip average over the last 22 trading days. So there can be some slowing of the move (i.e. some consolidation). Putting it another way, the shorts who are getting used to the ups and downs of the rough waters, may look at the gains and say, “Let’s take a little off the table, just because I’ve seen this story before” We are also at the midpoint – a very nice place to stop or at least stall.

Longs, who are out of sync today today, are hoping for a correction back toward the 100 hour MA now (at the 1.2690 level). I would think that should be it – if there is a rally.

Do you go long here? I can’t shake the “I would rather be short/bearish” feeling for the EURUSD, but risk can be defined by the 50% and the low at 1.26387. So if you feel the urge, go ahead but be careful. What you want to see is a move above the 1.2663 area (1.2660 was the low from November 2012 and 1.2663 has been a bounce high and two lows in recent days -see green circles in the chart above), but I would expect sellers up toward the 100 hour MA at the 1.2690 area. So it should just be a trade – that is if the support level holds.

For shorts looking for more today (going forward) the 1.26107 is the 61.8% of the October range and the low on Friday comes in at 1.26048. That would be a pretty good day to get to there.