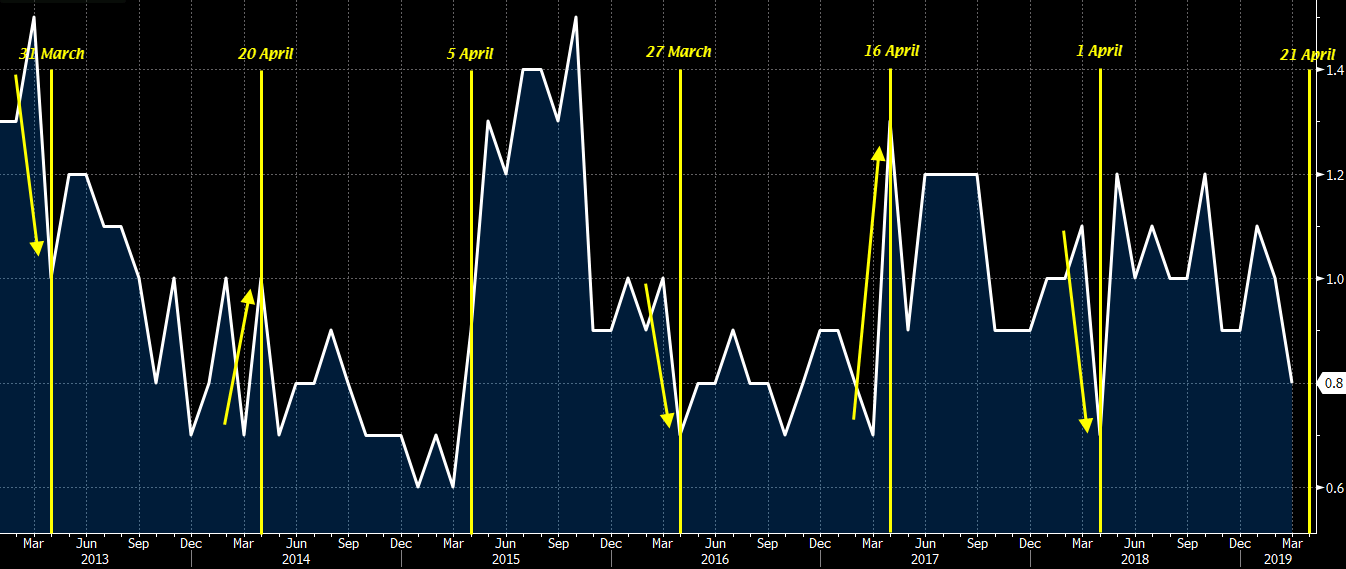

The Easter bunny is out with some tricks again this year

Eurozone core CPI data relative to Easter dates of that particular year

The simple analogy here is that when Easter falls on a later date in April, it tends to boost inflationary pressures for the month itself. On the flip side, if Easter falls on late March or the first few days of April, it tends to cause inflationary pressures in April to fall.

So, why is that the case?

It's due to the fact that the Easter holidays tend to boost prices because of increased demand on items such as package holidays, airfares, and restaurants & hotels. And that is evident to what we have seen over the past few years as shown above.

The only caveat in the above chart is 2015 whereby Easter fell on 5 April. Before Eurostat did their rebase on inflation data earlier in February this year, core CPI in April 2015 was only seen at +0.6% y/y which was similar to that of March 2015.

Hence, I would classify that data point as an anomaly rather than a break of the trend. Besides, we already saw the effects of the Saxony report earlier this week and that should be evidence enough for why the expectation is for Eurozone core CPI to improve to +1.0% y/y from +0.8% y/y in March.

If anything, I would expect the reading to possibly overshoot the expectation but even so, just be reminded that any boost from Easter seasonality doesn't tend to have a lasting impact on sustained inflation in the region. So, in the grand scheme of things, this won't warrant a more hawkish ECB unless we see May and June readings keep up with the jump today.