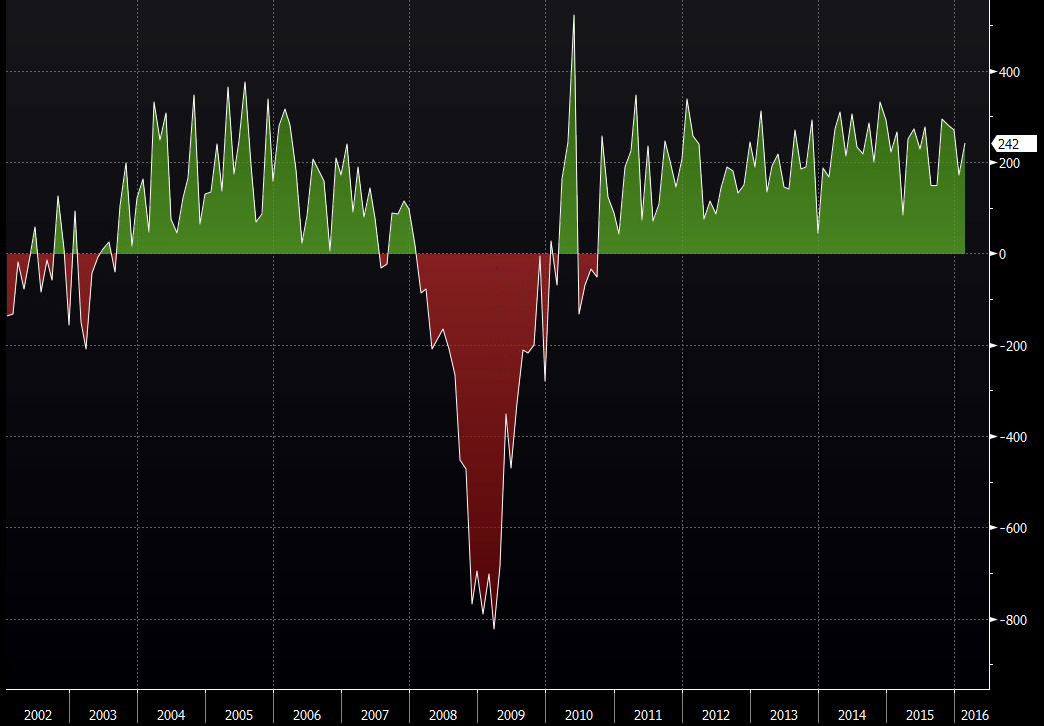

Details from the February 2016 US non farm payrolls data report 4 March 2016

- Prior 151k. Revised to 172k

- Unemployment rate 4.9% vs 4.9% exp. Prior 4.9%

- Average weekly earnings -0.1% vs 0.2% exp m/m. Prior 0.5%

- 2.2% vs 2.5% exp y/y. Prior 2.5%

- Average weekly hours 34.4 vs 34.6 exp. Prior 34.6

- Participation rate 62.9% vs 62.8% exp. Prior 62.7%

- U6 underemployment 9.7% vs 9.9% prior

- Private payrolls 230k vs 185k exp. Prior 158k. Revised to 182k

- Manufacturing payrolls -16k vs 0k exp. Prior +29k. Revised to +23k

- Gov payrolls +12k vs -7k prior. Revised to -10k

- Household employment 530k vs 175k exp. Prior 615k

The headline jump and that drop in the weekly hours (I might have got a little turned around on the work week hours. A rise alongside a gain in wages usually signals a tightening, while the opposite can mean that there's greater capacity), is what's helping lessen the drop in wages. Add the participation and U6 into the bullish report sentiment too.

It's a good report but not earth shattering. The headline number takes us back into the 200's and where we've been consistently. What will keep USD buyers and rate watchers happy is that more people now officially looking for work and the U6 is down also.

I might have got a little turned around on the work week hours. A rise alongside a gain in wages usually signals a tightening, while the opposite can mean that there greater capacity

US NFP