Holding support gives the pair some lift in early NY trading

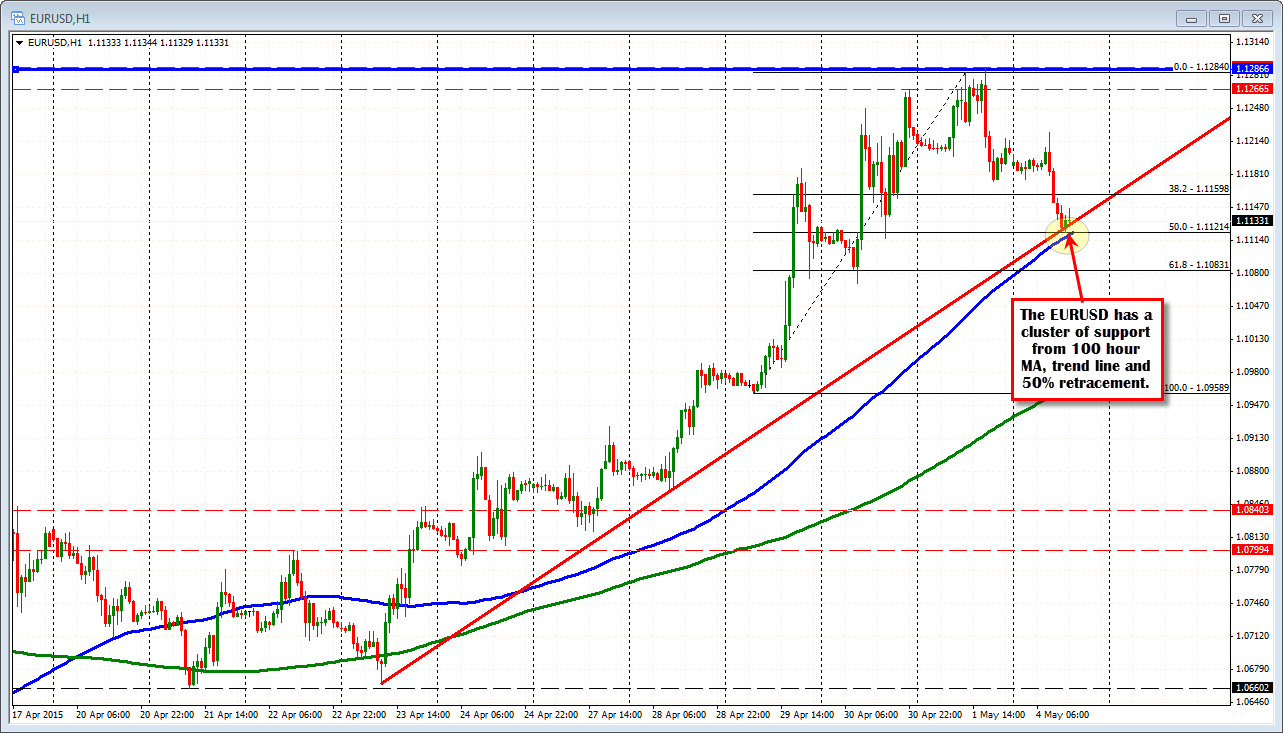

The EURUSD has successfully tested a key technical area on the first test in trading today. At the area is the:

- 100 hour MA (blue line in chart below at 1.1120),

- the 50% retracement of the move up from the consolidation lift-off point on April 29 (at 1.11214), and

- the trend line extending from the April 23 low at 1.1129

This is the first key test area after last Friday found sellers against a key resistance level at the 100 day MA (see blue line in the chart below - today that level is at 1.12866). The trader sentiment turned around on Friday after the price got to within 10 pips of that key moving average and fell back below the 1.1266 area which was also a key level for traders (see chart below). Should the price be able to rebound back higher this week, that would be a key area once again. The price of the EURUSD has not traded above the 100 day MA since May 13, 2014 - nearly 1 year ago.

Looking at the 5 minute chart below, let's keep the 100 bar MA as a theme - and a target. The 100 bar MA (blue line in the chart below) comes in at the 1.1162 level. This also corresponds with 38.2% retracement of the move down today (at 1.11609). Look for sellers on a test of this level - at least on the first look.