Price did trade briefly below MA for first time since March 17

The EURUSD traded briefly below the 100 hour moving average at 1.0916. The low came in at 1.0912. However, we are seeing a bounce off that level on the first look.

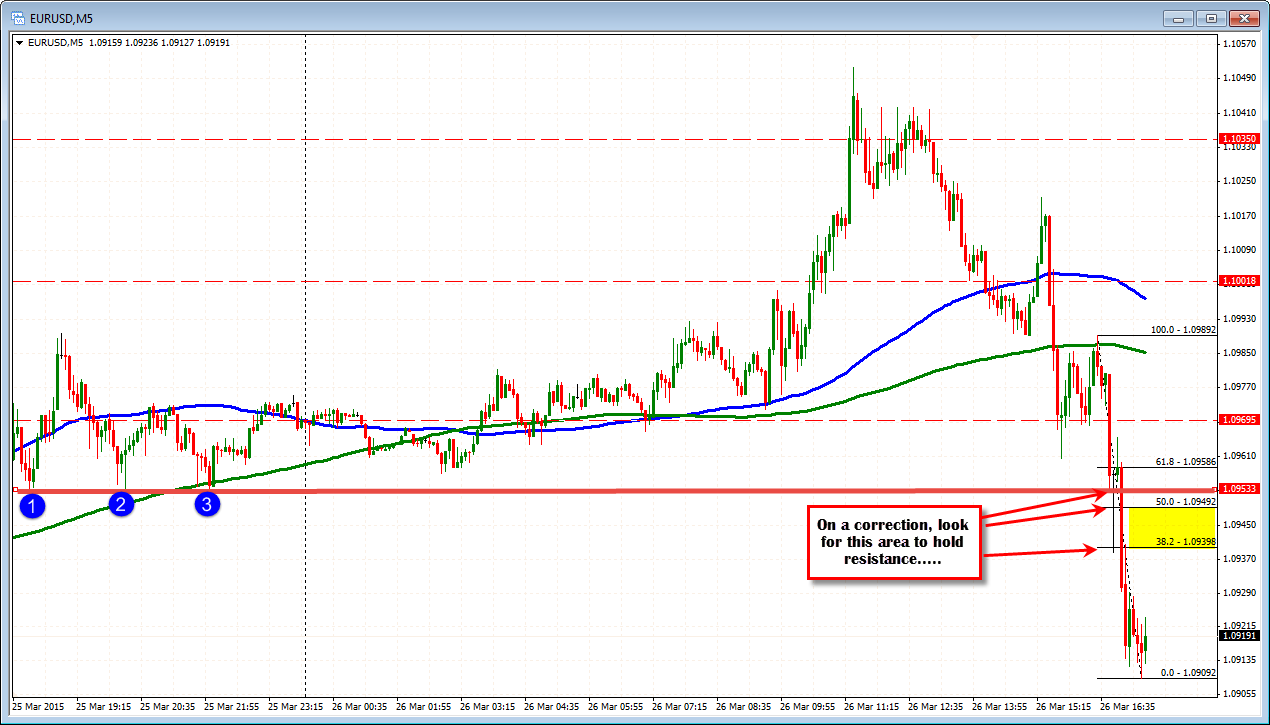

Before and after the FOMC spike on March 18, the EURUSD found buyers against the 100 hour MA (see blue MA line in the chart below). Of course the price is much higher now, so it becomes more difficult to hold support (all things being more or less equal fundamentally). A break below will look toward the 1.0881-90 area where there are a number of lows (see red horizontal line in the chart below).

Traders buying off the 100 hour MA area, should find sellers in the 1.0940-53 area (see 5 minute chart below) Should the price correct to this area, this will be a test for the EURUSD buyers (and sellers for that matter). If the price moves above the area, the buyers against the 100 hour MA feel more confident. We could/should see more upside potential. Stay below on the correction, and the 100 hour MA becomes more vulnerable for a break and further downside momentum.