Support against trend line stalls the fall.

The GBPUSD has moved lower for the 6th straight day (the close yesterday came in at 1.53098). However, the fall lower did find support buyers against a lower trend line on the four-hour chart. That level comes in at around the 1.5235 level (see 4-hour chart below). This level will need to be broken to look toward the next target at the 1.5191 level. This is the 50% retracement of the move up from the April 13 low.

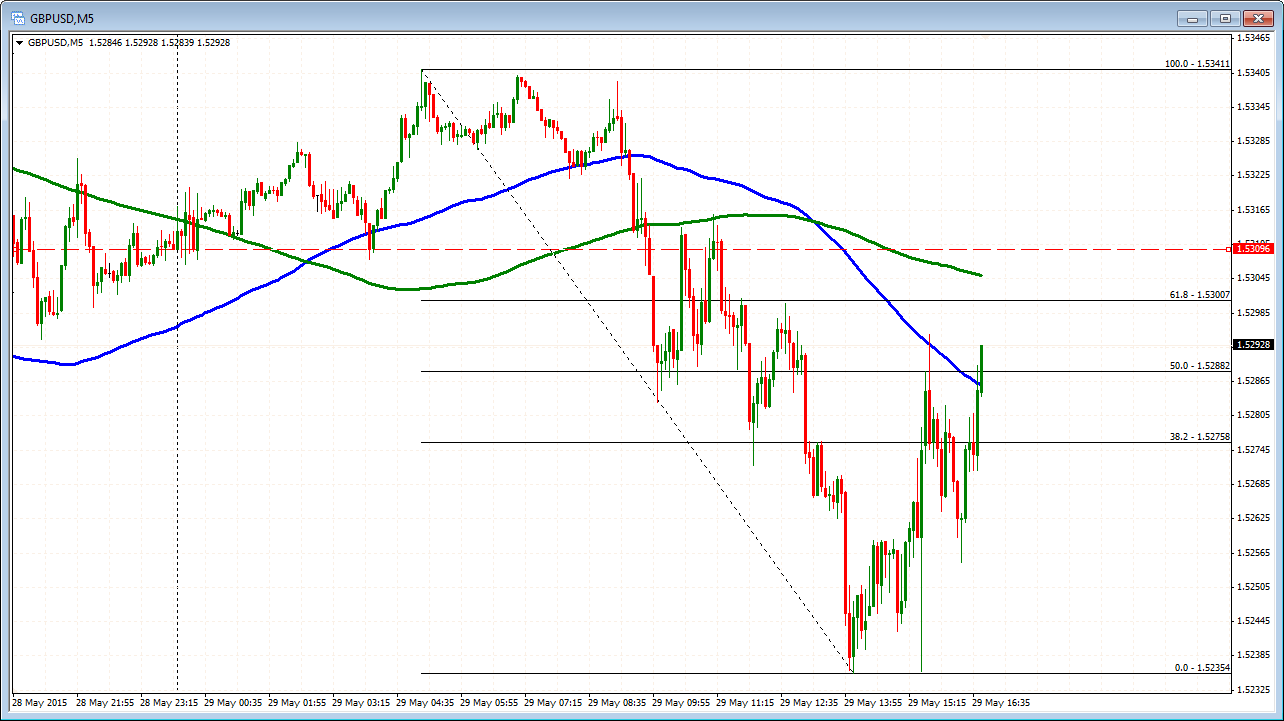

On the topside the 200 bar MA on the four-hour chart is now resistance (green line in the chart above). That level comes in at 1.5308. The price fell below this MA earlier today and has been able to stay below it over the last 8 or so trading hours. This is also near the closing level from yesterday so any move above, will likely give the pair a momentum boost higher.

The current price is right between those two extremes. The Chicago PMI is a bit weaker so we are getting a boost at the moment. The midpoint of the days trading range is being tested on the 5 minute chart (well moving above it at the 1.5288). It is also moving above the 100 bar MA (held the level last time). One final piece of news in the Michigan Confidence to come. If it is weaker (this is the 2nd cut - the expectation is for better at 89.5 vs 88.6), the 1.5309 will be on the radar. If stronger, back below the 50% and 100 bar MA and should stay below....