Retail sales and stronger inflation ignored

The USDCAD is ripping higher - ignoring the stronger than expected retail sales (+1.7% vs. 0.5% estimate) and CPI inflation (+0.7% MoM vs +0.6% est. YoY +1.2% vs. +1.0% estimate) data in trading today.

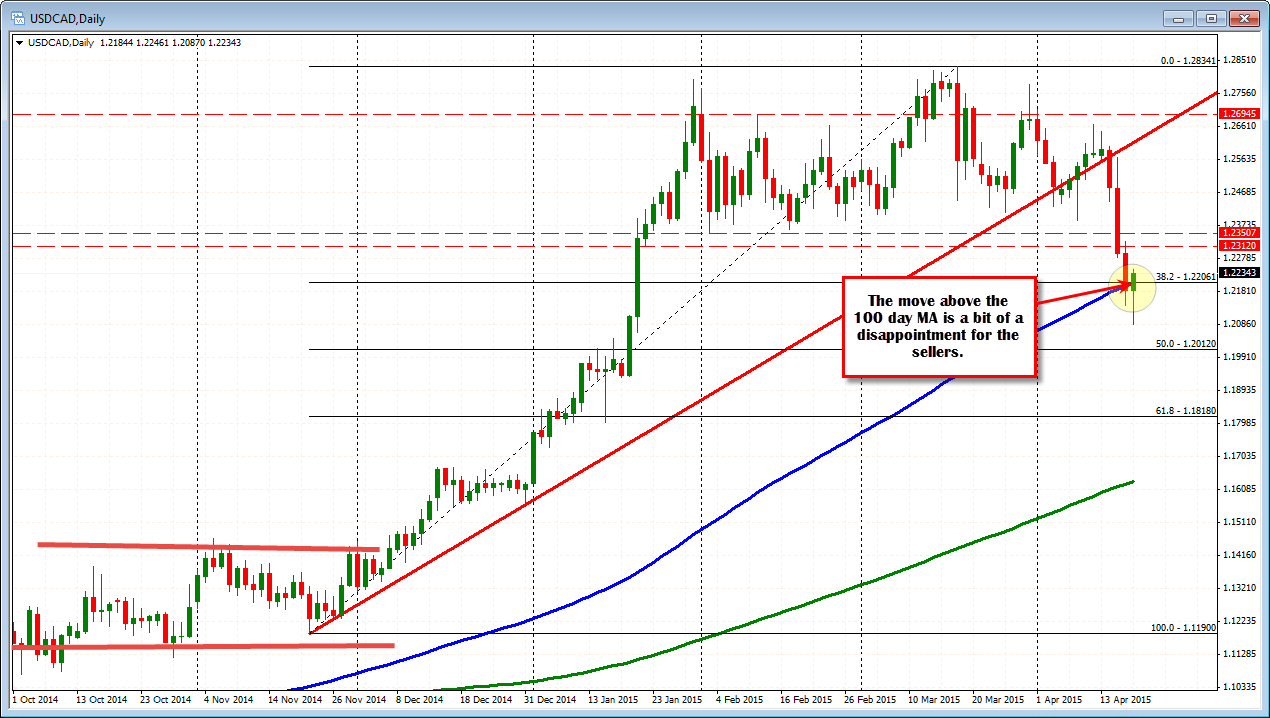

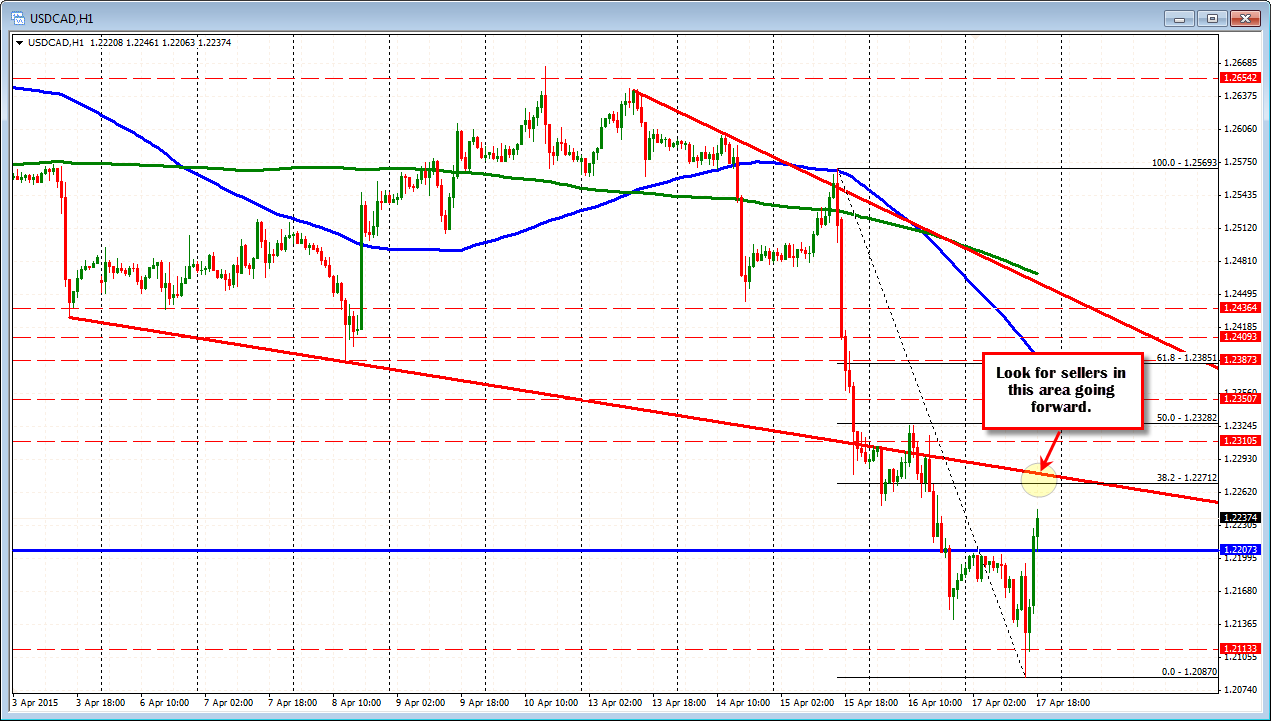

The USDCAD has been a big trender to the downside in trading this week. So the move higher is a small correction of the move. But it has taken the price back above the 100 day moving average and broken 38.2% retracement at the 1.2207 area (see daily chart below). This is bit of a disappointment for the sellers and may be contributing to the squaring up that is occurring before European and London traders exit for the weekend.

Oil prices are also down on the day (-0.93%), breaking a string of 5 days higher prices.