Forex Trading and Economic News for October 17, 2014

- OECD says that French reforms could as as much as 0.3% to GDP

- Fed’s Rosengren says Europe faces significant problems

- The data and Yellen coming up at 12.30 gmt

- The strongest and weakest currencies in the forex market today

- September 2014 Canadian CPI 2.0% vs 2.0% exp y/y

- US Housing Starts 1017K vs 1008K, US Building Permits 1018K vs 1030K

- USD/CAD drops to 1.1210 after CPI data

- USDJPY Technical Analysis: Up but steady but 100 hour MA contains

- Yellen says inheritance is a significant source of economic opportunity

- EURUSD Technical Analysis: Is there another move before the weekend?

- Good start for US stocks as things settle down

- October 2014 US Michigan consumer sentiment index flash 86.4 vs 84.1 exp

- Four German banks may fail bank stress tests – German press

- GBPUSD Technical Analysis: Cluster of support at the 1.6049/54 area today

- Suggested German banks…

- S&P looking good, but big levels yet to be tested

- SocGen pushes back BOE rate rise

- USDCAD Technical Analysis: Trades between the “Goal Posts”

- The weeks moves are already fading into memories but is that really the end of it?

- Someone wants to see the euro go out on the downside

- Hollande says global growth is too weak

- IMF’s Lagarde says markets are overreacting

- Putin says terms have been reached on winter gas supply to Europe

- European stocks mostly down on week, but things could have been much worse

- No sign of Ebola among nurse’s Ohio friends. Residents of Ohio are happy

- Remind me to not listen to Mark Cuban again….

- CFTC Commitments of Traders: No one wants to sell the dollar

- GBPJPY Technical Analysis: Ending the week at a level that buyers and sellers can like

- BOE’s Weale says rates should rise now – Telegraph

Stock Market :

The stock market in the US today ended strongly:

- Dow +263.17 to 16380.41

- S&P +24.00 to 1886.76

- Nasdaq +41.05 to 4258.44

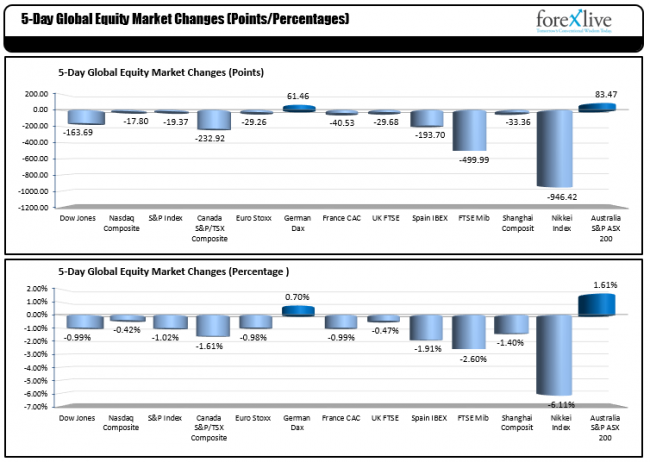

For the week, the major global indices recovered from the ashes. Below is the point changes and percentage changes for the trading week:

The global stock markets were mainly down but what the graph does not show, is the recovery from the low.

From an economic standpoint today, the US Housing data came in near expectations. Housing starts rose from 957K in August to 1017K in September, while Building permits also rose to 1018K from 1003K in August.

The University of Michigan Confidence survey for October rose to 86.4 vs 84.6 last month and a 84.0 estimate. The level is the highest since July 2007. The Consumer confidence component remained near high levels at 98.9 (the high level going back to July 2007 was 99.8 reached in August 2014). The Economic Outlook component was equally as positive. It rose to 78.4 from 75.4 last month. This was the 2nd highest reading going back to – once again – July 2007. My guess is that the survey results were not skewed by the action in the markets this week.

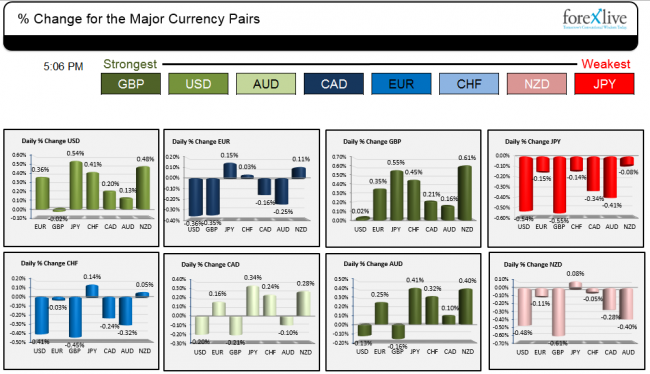

The strongest and weakest currencies in trading today

The strongest currency today was the GBP it rose against all major currencies in trading today. The weakest currency was the JPY as the flight into the relative safety of the JPY was unwound with the higher stock markets today. The greenback was up against all the major currencies with the exception of the GBP today. The dollar benefited from better data, and a more buoyant stock market.

The % changes of a currency vs each major currency

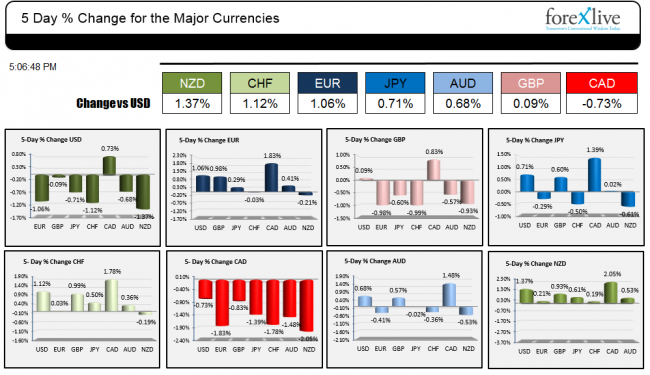

For the week, the dollar was down against all the major currencies with the exception of the CAD. The strongest currency for the week was the NZD. It rose against all major currencies. The weakest was the CAD. The Canadian dollar was hurt by oil prices which tumbled from 84.90 to a low of 79.10 before rebounding on Thursday. Today, oil was little changed.

Gold this week moved from 1222.52 to 1249.60 and closed at 1238.25.

Have a great weekend.