Forex news for Asia trading for Wednesday 11 November 2020

- BNZ on the RBNZ - Negative rates less likely

- ANZ on why USD/JPY is going back above 106

- ANZ says the RBNZ has less justification for rushing into a negative OCR

- RBNZ (finally) gives an indication of the size of FLP program: 28bn NZD

- RBNZ Gov Orr says NZ domestic economic activity has been more resilient than earlier assumed

- NZD on the rise after the RBNZ

- RBNZ leaves cash rate unchanged, LSAP NZD100bn

- China to allow unseating of Hong Kong MPs from local parliament

- Australian long bond yield rises to its highest since March

- Coronavirus - Nevada Governor says need a 'stay at home' mentality for the next 14 days

- US coronavirus - hospital admissions have now surpassed their April peak

- PBOC sets USD/ CNY reference rate for today at 6.6070

- FX option expiries for Wednesday November 11 at the 10am NY cut

- COVID-19 - Dr. Fauci says Pfizer vaccine EUA could mean its available as early as December

- US Equity index futures (ES) has turned negative on Globex after a good start

- South Korea first 10 days of Nov exports show a solid rise

- Australia monthly Consumer Sentiment for November +2.5% m/m (prior +11.9%)

- Trump campaign files court case in Michigan to stop certification of huge Biden win

- Hedge fund manager Ackman says markets too complacent about the coronavirus

- Short term fair value model has AUD/USD at 0.752

- Goldman Sachs are forecasting further yuan appreciation against the USD

- Trade ideas thread - Wednesday 11 November 2020

- Fed's Rosengren says the Federal Reserve will be patient before raising rates

- Where to for the NZD on today's RBNZ policy meeting (preview)

- Private oil survey data shows larger than expected draw in headline crude oil inventory

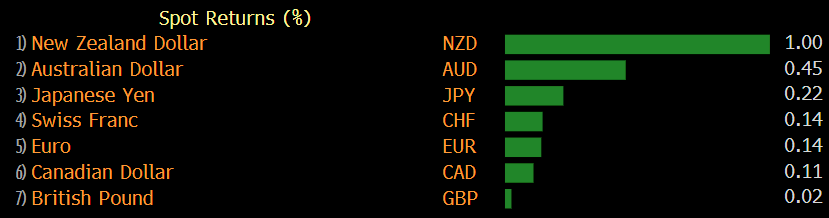

The New Zealand dollar was the big mover in Asia today, sharply higher against the USD. The USD lost ground elsewhere also, but the kiwi was the outperform. I've separated out the Reserve Bank of New Zealand news in the bullets above as they were the catlyst if you want to read more, but in summary here:

- The RBNZ were not hawkish, maintaining a dovish tone about its medium-term outlook

- But, the Bank did nod to improving data domestically and internationally

- And it remains prepared to do more policy accommodation if needed

- The RBNZ did not change the cash rate, the size of its QE program nor its cash rate forecasts

- But, and this was a big kicker for the NZD, its "unconstrained OCR track" indicated the Bank now views that around 100bp less stimulus is necessary ... consensus expectations had been for the RBNZ to move to a negative cash rate from March 2021 (the Bank has committed to keeping the cash rate unchanged until then, and reaffirmed this today)

- It said its new Funding for Lending Programme (FLP) will launch in December (size circa 28bn NZD ... we only got the size indication after the announcement at Governor Orr's press conference)

Markets repriced the probability of a negative cash rate, pricing it out. The New Zealand dollar was taken higher, getting as high as just above 0.69. Its just under there as I update.

AUD/USD traded higher but not as dramatically, helped along by rising bond rates (as they are elsewhere also).

Other new and data was light indeed. We had no new developments on vaccines today, although the US' Dr. Fauci did a media interview expressing expectations the Pfizer vaccine would be available for emergency use in December. While on coronavirus, the US new case count soared above 100,000 again today, and Nevada's Governor suggested its population stay at home. Trump continued to publicly sulk about the election outcome, suggesting it was rigged. The postal worker who said he witnessed irregularities admitted he had fabircated the story. He had received more than USD130,00 in donations on the back of his story. Not a bad payday (if you get away with it, he hasn't).