Forex news for Asia trading Tuesday 20 August 2019

- PBOC Vice Governor says there is room for interest rate cuts, and to RRR

- Support and resistance levels for AUD/USD

- Peaceful protest in Hong Kong over the weekend, followed now by an upbeat Lam new conference

- Reports of firming China demand for commodity imports

- China's first reformed LPR one year rate comes in slightly lower

- RBA Minutes: AUD fall to support exports, tourism

- PBOC sets USD/ CNY mid-point today at 7.0454 (vs. yesterday at 7.0365)

- North Korea slams South Korea for conducting a joint military exercise with the US - 'stupid act'

- More on the silence expected from the G7 this weekend - trade tensions toll

- The PBOC's lower rates on new loans to business kicks in today … but …

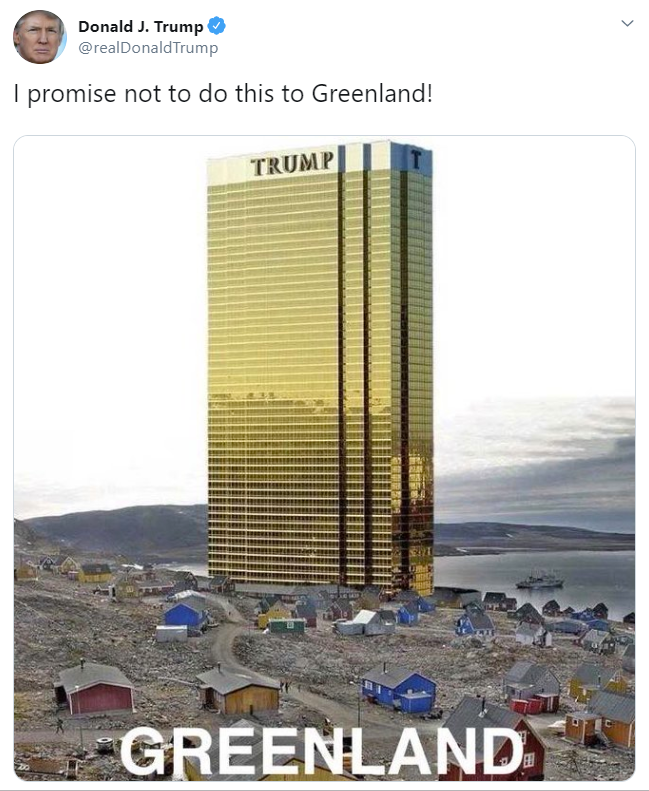

- President Trump tweet …. OK, this is a good one!

- Australia weekly consumer sentiment, ANZ/Roy Morgan survey: 112.8 (prior week 115.5)

- South Korea again with the forex intervention comments

- Barclays assess Brexit impacts: GBP, house prices to fall, inflation to rise and a recession

- Reports UK PM Johnson holding out on the US in trade talks

- US State dept: Effort to assist Iranian tanker could be viewed as support to terrorist organization

- Japan media reports the G7 summit this weekend may end acrimoniously due to trade dispute

- Brexit - EU responds to UK PM BJ's letter - a polite middle finger. As expected.

- Risk that Fed Chair Powell could disappoint markets this week at Jackson Hole.

- Brexit - More on the UK PM's letter to the EU (TL;DR - its laughable)

- Trade ideas thread - Tuesday 20 August 2019

- White house scrambling to prop up economy - eyeing payroll tax cut

- Long AUD/NZD trade idea - what should drive the cross higher.

The Australian dollar was the mover during the session today, albeit in a small range. Not as small as others though.

News and data flow was light, the focus was on the Reserve Bank of Australia minutes from the August meeting. There was nothing surprising in the minutes, the RBA has an easing bias and for now remains in monitoring mode. The Australian dollar had fallen in the morning ahead of the minutes (the only data of note was another drop in consumer sentiment) before rebounding. The minutes release saw a very slight dip before AUD/USD headed off to its session high around 0.6780. Its not much form there as I update.

Kiwi played out a similar sort of pattern, without quite so much early weakening and without so much later strength.

EUR/USD has tip-toed ever so slightly higher, as has cable. USD?CAD and USD/CHF are a few small tics lower.

USD/JPY is also little changed on the session, as is gold.

Tpday was the first day of the new LPR in China (see bullets above), with slightly lower rates for lending that will act as (at least) small stimulus.

Morgan Stanley cut their Hong Kong 2019 GDP growth forecast to -0.3% from 1%.

Still to come:

- NZD traders - heads up for the GDT dairy auction coming up Tuesday, London time

- FX option expiries for Tuesday August 20 at the 10am NY cut

- If you are waiting for the agenda of the Federal Reserve Jackson Hole symposium - info

President Trump is getting better at the Twitter thing, with this during the US evening (real tweet):