Forex new for Asian_Pacific trading on December 7, 2017.

- Bitcoin corrects to intraday support and pushes back above $14K

- BOJ's Kuroda: BOJ will do whatever it takes to achieve mandates

- Australia's main stock exchange to start using blockchain technology

- Japan sells 30 year bond at average yield of 0.8480%

- More from BOJ's Kuroda: It is important for BOJ to keep aiming for 2% inflation target

- US banks expect trading revenue to fall in Q4 2017

- Forex technical analysis: GBPJPY's floor yesterday, is the ceiling today

- Japan markets rebound today.

- Tokyo average office vacancies for November come in at 3.03 versus 3.02

- PBOC: IMF report stress test comments not the full picture

- PBOC sets Yuan midpoint at 6.6195/dlr vs last close 6.6145

- IMF: China's apparent primary goals for jobs, growth conflicted w/ financial objective

- Australian trade balance for October A$105M vs. A$1400M estimate

- Bitcoin technical analysis: The digital currency eyes $14,000 next. How can you manage your huge gains?

- Saudi Arabia: US decision is unjustified and irresponsible

- Reuters Tankan suggests that BOJ Tankan report to be firm

- Comments from RBNZ: The economy continues to perform well

- Juncker: Fears PM May's government will collapse without a Brexit deal

- AiG performance of construction index for November comes in at 57.5

- The biggest winner and the biggest loser in the forex market today

- ForexLive Americas FX news wrap: Canadian dollar clobbered

A snapshot of other markets are showing:

- Japan stocks rebound. Nikkei 225 is trading up 1.11% while the Topix index is up about 1.02%

- The Hang Seng is trying to rebound but is trading near unchanged levels currently

- The Shanghai index is lower by -0.62%

- Spot gold unchanged at $1263.34.

- WTI crude oil is up $0.20 or +0.36% at $56.16. If there is more downside, look for support at the $55.00-$55.24 area.

- Japan auctioned off a 30 year bond at an average yield of 0.848%

- US 2 year is at 1.806%, unchanged. The 10 year is at 2.342%, up 0.3 bp. The 30 year bond is at 2.7285%, unchanged

- Bitcoin traded up to $14,400 - a new record (what's new) - and trades at $14,290. Bitcoin me up and up and up and up....

The Asian Pacific session saw the Australian trade figures disappoint. The surplus came in at A$105M vs expectations of A$1400M. That was a bit disappointing and it sent the AUD lower.

There was also report from the IMF which criticized China on their plans for jobs and growth, while trying to fix the banking and debt situation at the same time. The dynamics of the desire to expand, while contracting credit, did not jive with the IMF.

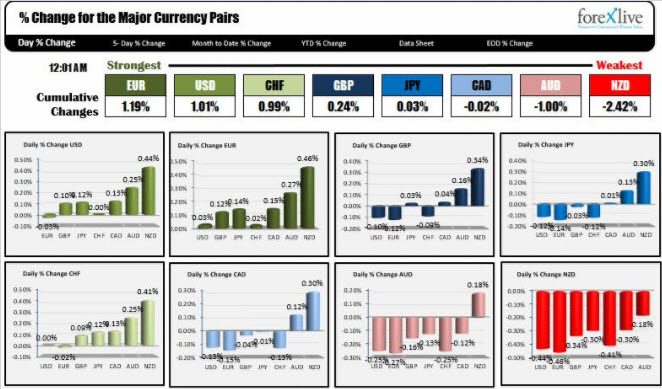

The combination of the AUD and the China report, seemed to have also hurt the NZD (no news out of NZ). As a result both the AUD and NZD were the weakest currency on the day (see table of the strongest and weakest currencies below).

The strongest currency of the day so far is the EUR followed closely by the USD. However, the changes are really not that dominating. Let's put this way, it won't take a lot to shake up the league table as European and London traders enter for the day.

Kuroda spoke in Tokyo and talked positively about the economy and higher inflation. It was a story that has been told before and economic activity is better, but the problem remains wages and inflation remain low.

IN trading today, the USDJPY wandered up to its 100 hour MA at 112..498 and stalled. That MA was broken to the downside in trading yesterday, which opened the door for the move down to the pairs 200 hour MA at 111.97. So what we know from the price action, is the pair is supported by the 200 hour MA below (at 112.06 and moving higher) but has rallies stall against resistance at the 100 hour MA above at 112.498. We currently trade at 112.40. Traders may be leaning against extremes now., but will be looking for a break and run too (once the market gets the push).

The EURUSD and the GBPUSD barely traded in the session. The EURUSD waffled in a 16 pip trading range between 1.1792 and 1.1808. Between those two sits the 100 day MA at 1.17965. The market has traded above and below that MA line over the last 16 hours with a low at 1.1780 and a high at 1.1808. We currently trade right that level. Like the USDJPY, the EURUSD is looking for a push.

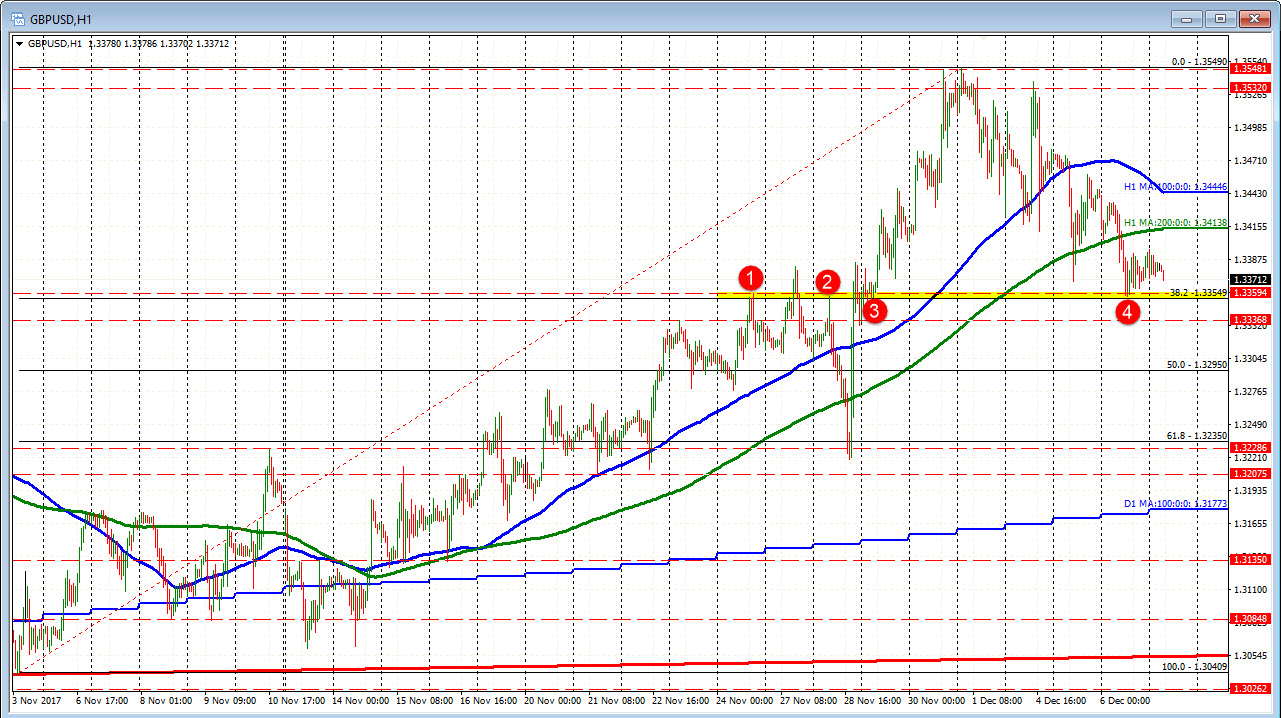

As for the GBPUSD, it had a 22 pip trading range after bottoming yesterday near the 38.2% of the move up from the November low. The pair remains below the 200 hour MA at 1.34138 (green line in the chart below). Those are that pairs level to eye as the London traders enter. The sellers are trying to take more control with the moves below the MAs, but need to get below the 38.2% level to continue to move lower.