Forex and cryptocurrency news from the European morning trading 15 Mar 2018

News:

- Germany's Altmaier says Germany doesn't want competition over trade tariffs

- SNB's Jordan says US protectionist tendencies are a big risk for Switzerland

- German officials say multilateral trade will surely be a big topic at G20 meeting

- China foreign ministry says a trade war is not in anyone's interest

- German business sentiment significantly hit by US trade policy and strong euro

- Russia foreign minister says they will soon expel British diplomats

- More from Villeroy: Rising protectionism presents a global trade risk

- Bitcoin's rough week sees it fall more than 30% from month's high

- Russian foreign ministry says UK PM May's accusation is 'extraordinarily dangerous'

- MAS says that their views on cryptocurrencies are "still evolving"

- SNB leave interest rates on hold

- Japan's Aso says that have to be very careful about foreign bond purchases

- BOJ's Kuroda says that Japan is basically at full employment

- More from Kuroda: Raising non-manufacturing productivity will raise wages

- Japan's Aso apologises again on Moritomo issue

- Japan's Aso is to skip G20 meeting to attend a parliamentary debate - Reuters

- Japan Fair Trade Commission said to have raided Amazon Japan offices

- UK's Davis says Brexit transition period is based on existing arrangements

- Norges Bank keeps key rate unchanged at 0.5%

- Norges Bank's Olsen says rate hike coming "after summer"

- Bank of France sees French growth at 1.9% in 2018

- Bank of France's Villeroy says that there is progress on inflation

- The US is pushing for Randal Quarles to take over as FSB chairman - report

- AUD/USD touches session lows on the day, what next?

- Nordea sees EUR/CHF weakening on politics despite SNB decision

- SNB's "highly valued" talk shows no hurry to change stance - Danske

- IEA raises 2018 global oil demand growth forecast

- Westpac says that negative view on the USD still persists

- The next PBOC governor may have his/her hands tied, says BNP

- TD Securities say that New Zealand Q1 GDP report was 'underwhelming'

- Trading ideas for the European session 15 March

- Nikkei 225 closes higher by 0.12% at 21,803.95

- ForexLive Asia FX news: yen strength on the menu today

Data:

- France February final CPI m/m 0.0% vs -0.1% prelim

- Switzerland February PPI m/m +0.3% vs +0.3% prior

- China Jan-Feb foreign direct investment +0.5% y/y

Lots of trade rhetoric and along with growing concerns on the Russian spy poisoning saga we've seen yen demand prevail.

USDJPY found support around 105.80 in Asia but failed to rally too far past 106.10 with large 106.00 option interest keeping range contained.

Yen demand overall has seen GBPJPY lower and GBPUSD cap at 1.3980 and retreat to test 1.3920 demand while EURJPY has also been in retreat but EURUSD finding option support at 1.2350

USDCHF has traded 0.9450-60 with SNB leaving everything unchanged apart from lowering inflation forecasts , EURCHF has drifted down into 1.1680 support again

USDCAD continues to flatline underpinned but sellers lurking while NZDUSD has drifted down through 0.7300. AUDUSD

Bitcoin has staged a rally to $8250 after falling further to lows of $7690

Gold has fallen to $1322 from $1328 before finding a little support while oil has risen with WTI climbing to $6130 from $60.80

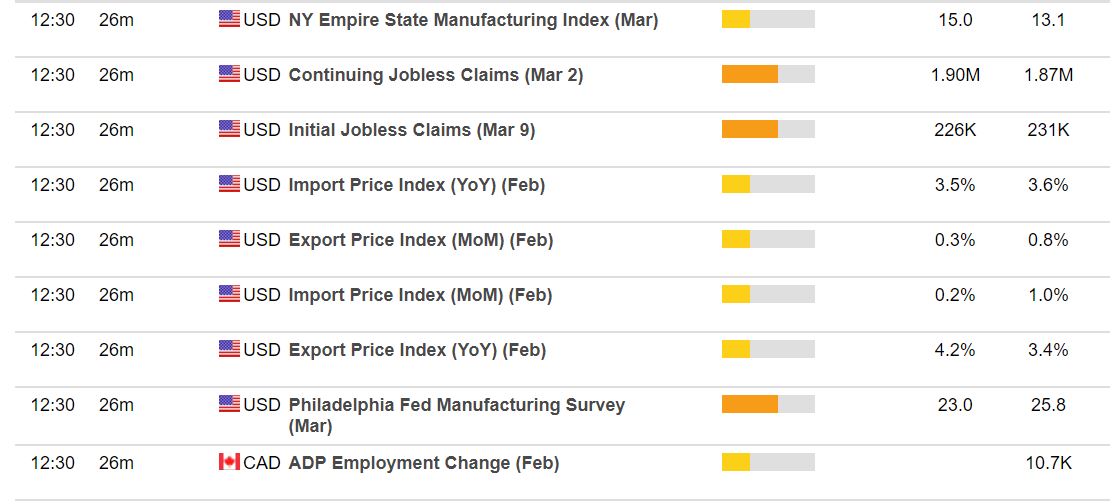

US data coming up: