Forex news for NY trading on September 21, 2017.

- No records today. Major US stock indices end in the red.

- Gold continues fall today. Tests 50 day MA. Stalls. What next?

- Mnuchin: No bank in any country should be used to facilitate N. Korea's destructive behavior

- US WTI crude oil futures settle at $50.55, down -$0.14

- Fade the Fed; a good level to sell USD/CAD - TD

- Forex technical analysis: EURUSD stalls in MA area (but just barely)

- Trump: New executive order to target individual, companies that trade w/ N. Korea

- Bitcoin technical analysis: Break higher yesterday...stalled.

- US 2Q household change in net worth 1698B vs 2327B last quarter

- Hawkish FOMC not a game changer for USD - Credit Agricole

- European stocks close with gains. Yields up a bit.

- Cable climbs to session high on fixing demand, May

- IMF forecasts French GDP growth of 1.6% compared to 1.5% previously

- Sept Eurozone flash consumer confidence -1.2 vs -1.5 expected

- ECB's Draghi: Financial system now poses fewer risks to real economy

- FHA July US house price index +0.2% vs +0.4% expected

- Philly Fed September business outlook +23.8 vs +17.1 expected

- US initial jobless claims 259K vs 302K estimate

- Canada July wholesale trade sales +1.5% vs -0.7% expected

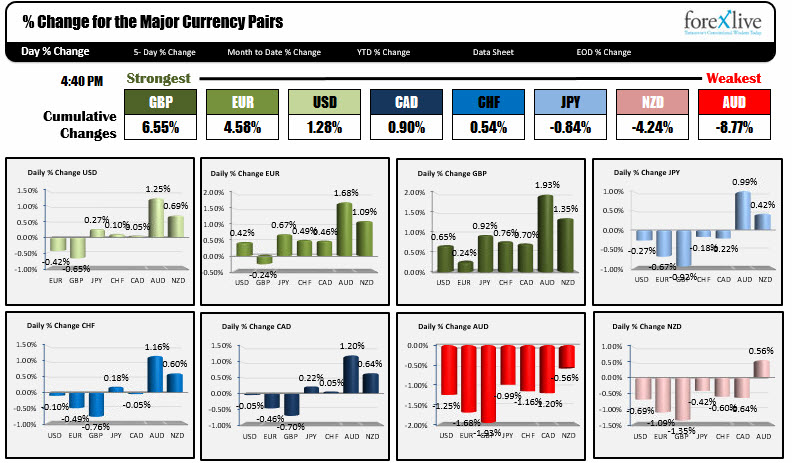

- The EUR is the strongest while the AUD is the weakest as NA trader start the day

In other markets today, the near end of day snapshot shows:

- Spot gold down -$9.75 to $1291.45. The 50 day MA stalled the fall today around $1288.30 (see post).

- WTI crude oil is trading at $50.71 up $0.02. The contract has had higher lows and higher highs over the last 4 trading days. The contract is also moving away from its 200 day MA (see post).

- US stocks had no record today. That is a shock. All three indices fell in trading today.

- US yields are ending unchanged to a little higher. 2 year 1.4385%, unchanged. 5 year 1.8862%, up 1.2 bp. 10 year 2.2765%, up 0.9 bp. 30 year 2.8034%, unchanged.

Do you remember 21st of September?

What will September 21, 2017th be remembered for?

- The day after the FOMC decision to start the balance sheet reduction.

The Fed announced they would start the balance sheet reduction yesterday and also expected to hike rates one more time in 2017 and 3 times in 2018. That news yesterday sent the dollar higher. Today the dollar moved higher against mainly the AUD, NZD and JPY but was lower vs the EUR and the GBP. Both of those currencies move higher vs the greenback. The GBP was the probably the catalyst. UK PM May in an effort to get Brexit negotiations kick started and ahead of her speech tomorrow in Florence, said the UK is willing to pay 20 billion euros during the transition period but only if it has access to the single market and some form of a customs union. That was worth a kick higher in the GBPUSD and the EURUSD wandered along with it.

- Additional US sanctions vs. N. Korea

President Trump and Treasury Secretary Mnuchin unveiled new sanctions against N. Korea and their leader - Rocket Man. The sanctions also have the support of China according to Mnuchin. The speech at the UN from Trump where the "Rocket Man" phrase was front and center and now the increased financial tension, has likely got Kim steaming. Will gold find a bid before the weekend. It fell below $1300 today and tested the 50 day MA at $1288 today. The markets have the courage of 1000 matadors (or so it seems).

- US wealth increased to another record. No stopping the wealth effect of higher stocks and real estate. Of course when people feel wealthy they also increase debt and we saw some of that too with the 2Q data. The data did not have a great impact as we are close to finishing the 3Q, but for the money counters, the gains were not as great as the 1Q but they were still not bad. I wonder how much of that gain went in the pockets of the top 1%ers?

- The aftermath of two natural disasters were being felt by the world.

The earthquake outside of Mexico saw the death toll rise to 273. The hopes of finding a child still alive in the school that claimed 19 young children, seems to be a story of false hope. Meanwhile, video from Puerto Rico showed mass destruction and devastation from hurricane Maria that battered the island with 155 MPH winds. The hope is it heads out to sea and takes its destruction with it. Power is cut across the island.

- US initial jobless claims were better than expected but Irma and Harvey impacted the data. The Philly Fed index was better than expectations.

- The GBP was the strongest currency on the day. The AUD was the weakest. Below is a look at the % changes.

A look at some of the major currency pairs:

EURUSD:

The EURUSD moved higher in trading today, but it did run into overhead resistance from the 100 hour MA at 1.1954 area. That is what I will remember most about today's trading. Going forward, if the price is to go lower and continue on with the decline seen after the FOMC yesterday, that MA line was the last line of defense for the bears. It held. Will it hold in the new trading day? That is what traders will be watching in the new day See post here.

GBPUSD.

The thing about the GBPUSD that makes it memorable today is that the high corrective level from after Brexit in 2016 were broken earlier this week, and held support on the post FOMC dip. Those levels came in between 1.3443 and 1.3532 and the low stalled at 1.3451. Moreover, not only did the GBPUSDs price move back above the 1.3532 level from the daily chart, but also moved above some key technical resistance on the hourly at the 1.3529 too (see post here). Good support held. The market bounced. The buyers are in control with risk at the 1.3529-32.

USDJPY

The USDJPY trading today will be remembered for finding support on the 200 day MA at 112.12. The price in the NY session moved down to the level, only to find the buyers right where they needed to show up. Of course risk can be defined and limited at that 200 day MA so they were not risking much. Nevertheless, the bounce was certainly memorable. The price trades as 112.46 in the new trading day, and unless the price goes below that 200 day MA, the upside is the way to go now. See post here.

Do you remember 21st of September? I hope you remember some of it and it helps you become a better trader.

Peace and prayers to those impacted by the most recent natural disasters.