Forex news for US trading on November 23, 2015

- US major stock indices close lower on the day

- Fed's Yellen: Most fed policymakers expect pace of rate hikes will be gradual

- Edmunds estimates November Auto sales rate at 18.3M

- US auctions 2 year note at high yield of 0.948%

- Italy sparkling at the European close

- Happy Fibonacci Day!

- ECB's Lautenschlaeger says now is a good time to assess pros and cons of QE

- October 2015 US existing home sales 5.36m vs 5.40m exp m/m

- November 2015 US Markit manufacturing PMI flash 52.6 vs 53.9 exp

- ESM to approve €2bn payment to Greece - Bloomberg

- October 2015 US Chicago Fed national activity index -0.04 vs +0.08 exp

- Fed's Tarullo says US economy is "chugging along" but still a mixed picture

- Oil rallying on Saudi comments could be a good fade

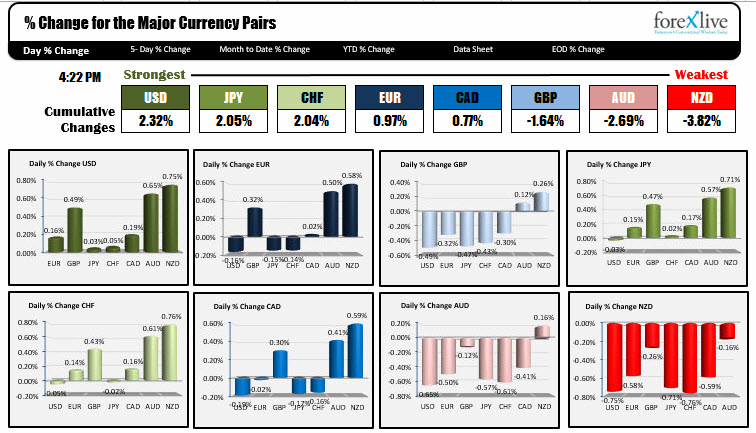

The US dollar was the strongest currency of the day, rising against all the major currencies. The dollar index printed 100.00 for the first time since March 16 (that was the high for the day). Other fun facts about the dollar index worth noting:

- The high for the year was on March 15 at the 100.39 level.

- Prior to that high, the last time the US dollar index was above 100 was June 2003.

- The dollar index peaked in the 21st century in September 2001 at 121.02.

- The low in the 21st century was at 70.698 in March 2008.

Fundamentally, US existing home sales came in a touch weaker than expectations at 5.36M vs 5.40M.

The EURUSD had an up and down trading session today and is ending the day near closing levels from Friday (at 1.0643. The current price is 1.0634). The pair had a barrier option at the 1.0600 level that provided a floor during the Asia Pacific session. However, that level was broken on the way to the day's low at 1.0591 toward the tail end of the London/European session. The rest of the NY trading day was spent moving back higher.

Contributing to the stronger bias was a rising EURGBP which based at the 100 hour MA at the 0.7004 level (the low was 0.7003). Buyers entered and by the close, the price had moved above the 200 hour MA at the 0.7030 level.

While the EURUSD was working it's way higher in the NY PM session, the GBPUSD was moving lower. Blame the better tone in the EURGBP for the selling pressure. The pair did find support at an old broken trend line at 1.5109 (see technical post outlining that level HERE).

The NY session started with the USDJPY falling back below the 200 hour MA at the 123.01 level. The break sent the pair down to the next target at the 122.80 level, where support buyers entered and pushed the price right back up to the 200 hour MA again. The pair is ending the day near the support trend line at the 122.80 level. A break below, could see further downside corrective action in the new trading day.

The NZD fell against all the major currency pairs today with most of the declines coming in the first 5 hours of trading. Against the greenback, the NZDUSD fell to a session low toward the end of the London morning session/beginning of the NY session (at 0.6492). The NY session was then spent moving up and down with a ceiling against the 200 hour MA (currently at 0.6519). That is where the day is ending for the pair. Traders will be eying a move away from this key area (the 100 hour MA and 50% of the move up from last weeks low is also at the area - see post).

US and European stocks ended down on the day. The UK FTSE and France's Cac were the worst performers.

US bond yields showed 2 years unchanged on the day. The 10 year yield was down 2 bp to 2.2377%. The 30 year yield fell 3 bp to 2.992%