Dennis Gartman says oil bounces will be short lived and he may be on the right side this time

Last month Dennis Gartman had a bit of a stinker on oil, managing to get stopped out of a short trade. While his trade may not have panned out I did like his execution

He's popped up on CNBC today to say that he doesn't see any bounces lasting and that he should have listened to his own advice

In the last few minutes oil has been on the blink again in both WTI and Brent. It's quite a while after the latest OPEC report earlier so we can't really point the finger there. The key factor from the report was that output in Nov rose 230k while a Reuters survey at the end of Nov only suggested a 130k rise

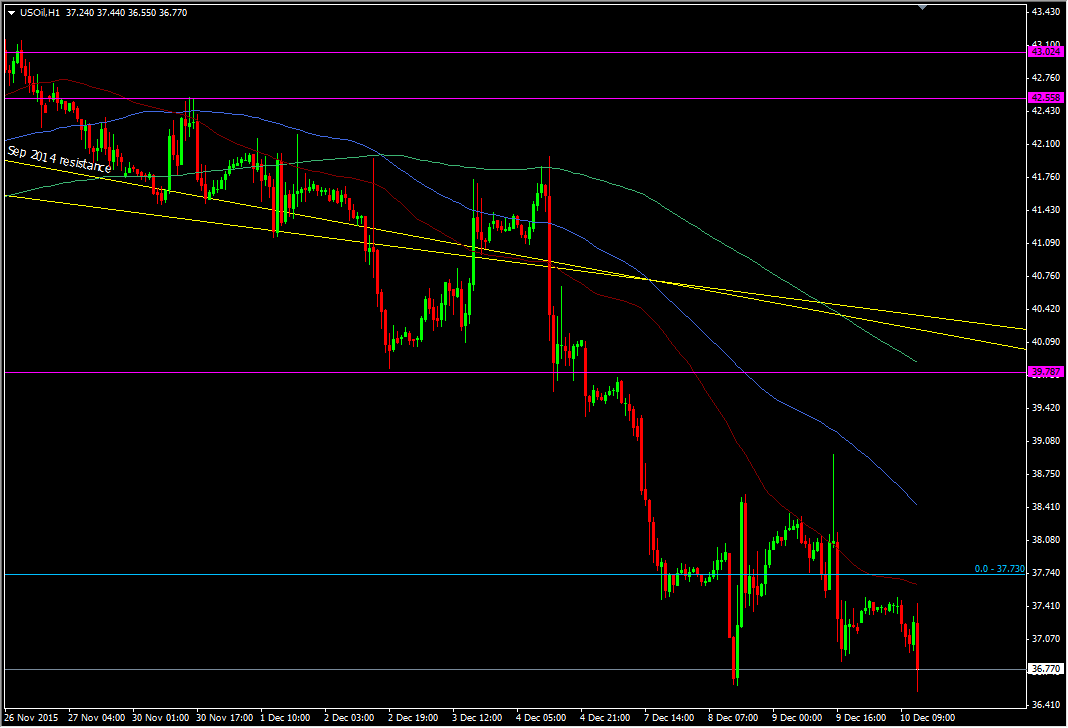

WTI lost nearly a buck in a few minutes and is now most definitely holding below the 37.70 level, and has found resistance around 37.50. We've also had a test of the 8 Dec lows and managed to grab a handful of ticks under it

WTI crude H1 chart

A good point was made by one of the other guests on the show who said the dwindling contango in oil is going to make it less profitable for those storing oil for future delivery and profiting on the spread. He noted that there were 54 ships holding around 31m barrels parked of the US gulf coast