There’s some nervousness in the gold markets today as a couple of reports show signs of slowing demand, particularly from Asia.

The WSJ reported late last night that Chinese demand is likely to be flat in 2014 and it cites the World Gold Council MD Albert Cheng who says that China’s pace of buying is unlikely to be maintained this year, especially if prices turn lower. He see them consolidation this year with demand increasing 19% by 2017. The full WGC China report can be found here.

Adding to the demand worries was a note from ANZ stating that Thailand’s appetite is one third of what it was last year with imports at 16mt Jan-Feb compared to 92mt a year earlier.

As I mentioned in the wrap, the falls are also being attributed to yesterdays retail sales but that’s a push considering it made it’s move on the release. We may be seeing some softness from possible expectation of a pick up in the US economy but these demand stories will trump that.

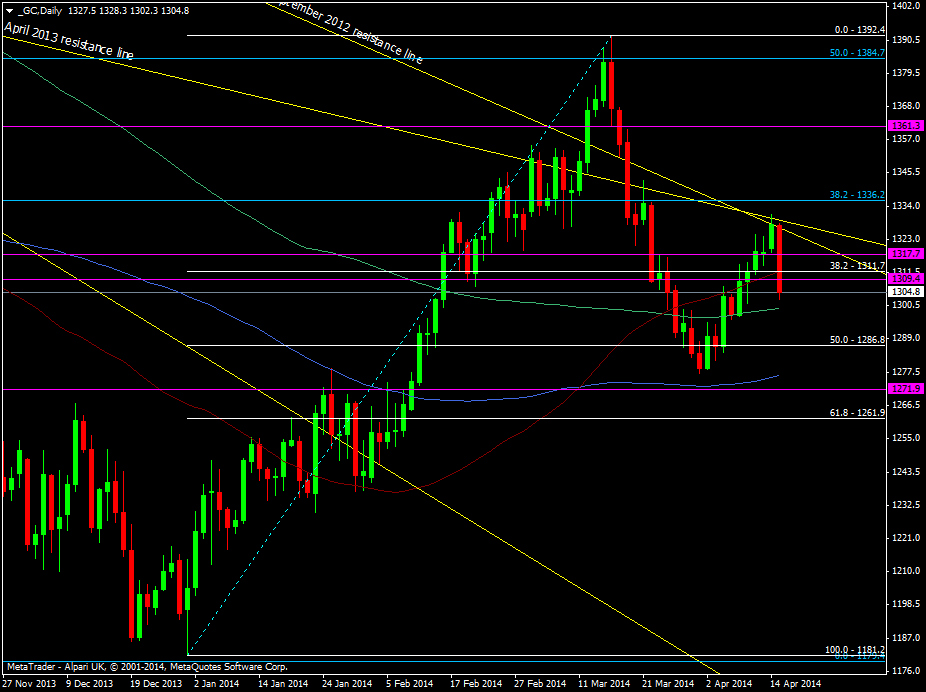

The shiny stuff was supported after the data yesterday at the old resistance level at 1317 but the overnight news has caused it to carve through the tech levels, though we’re holding just above the 200 dma at 1299 for now with a low at 1302. A break there targets the early April lows and 100 dma at 1277

Gold daily chart 15 04 2014