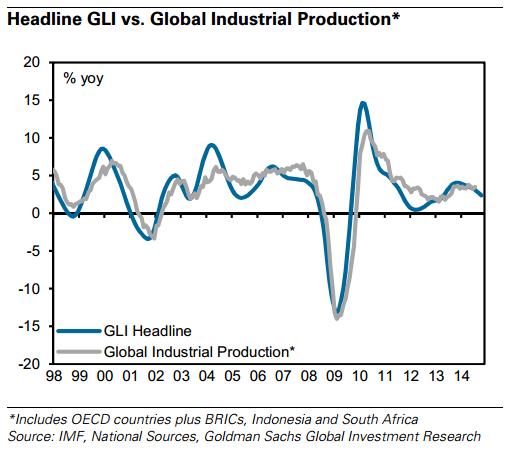

A Goldman Sachs research note on their Global Leading Indicator (GLI) says “October Advanced GLI – Deeper ‘Slowdown’ as market declines”

- October Advanced GLI came in at 2.4% y/y, down from last month’s reading of 2.6% y/y

- The reading places the global industrial cycle deeper in the ‘Slowdown’ phase, with momentum (barely) positive and declining

Five of the seven Advanced GLI filtered components have worsened in October so far:

- S&P GSCI Industrial Metals Index and AUD and CAD TWI aggregate components, two market-based gauges, down from last month (they cite the recent “growth repricing” & USD appreciation in markets) – but GS thinks this recent shift in the markets was not fully justified by the macro data, and so the deeper move reflected here may be overstated

- The Philadelphia Fed headline (the Advanced proxy for the Global PMI) and Philly Fed New Orders less Inventories components also continued to come in softer, while the volatile Baltic Dry Index also declined this month after last month’s improvement

- On the positive side, in the US, the University of Michigan survey (an early proxy for our Consumer Confidence aggregate) and US Initial Jobless Claims came in stronger for a second month.

–

Just to give you something else to worry about over the weekend.