A special congressional election in the US is happening, we should be getting results trickling in from 8pm NY time (0100GMT) when polls close. I know, you're on the edge of your seat, right?

On the data front from Asia today:

2145GMT from New Zealand - BoP Current Account for the final quarter of 2017 (aaaand, you're still on the edge of your seat, amIright?)

This is expected to indicate the annual current account deficit widened slightly to 2.6% of GDP

- goods trade deficit is expected to have widened in Q4, big jump in imports (aeroplanes and capital equipment feature), a smaller rise in exports

- services, surplus expected pretty much unchanged - plenty of tourist spending

- smaller investment income deficit expected

The numbers:

- Balance of Payments Current Account for Q4 expected NZD -2.45bn, prior -4.68bn

- Current Account GDP Ratio YTD expected -2.6%, prior -2.6%

ps. Tomorrow we get the Q4 GDP figure from NZ ... which is the focus for the week from New Zealand

2210GMT - Australia - Speech by Christopher Kent, Assistant Governor (Financial Markets) of the Reserve Bank of Australia, at the KangaNews DCM Summit in Sydney. This should be of interest, if you're trading the AUD tune in for headlines. The RBA is currently well on hold, and that looks set to continue for a good few months to come. Next move .... up or down? Up seems to be the crowd favourite, but not soon.

2330GMT - Australia - Westpac Consumer Confidence index for March

- prior was -2.3%, impacted by the global market volatility in February. While there is no expectations survey for this its likely to recover somewhat.

Yesterday we got 'business confidence' data (link), which has been tracking ahead of consumer confidence.

2350 GMT - Minutes of the BOJ January meeting. The minutes are pre-empted weeks in advance by the 'Summary of Opinions'. For this BOJ meeting the summary was out on January 31.

2350GMT - Japan - Core Machinery Orders for January

- expected +5.2% m/m, prior -11.9%

- expected -0.7% y/y, prior -5.0%

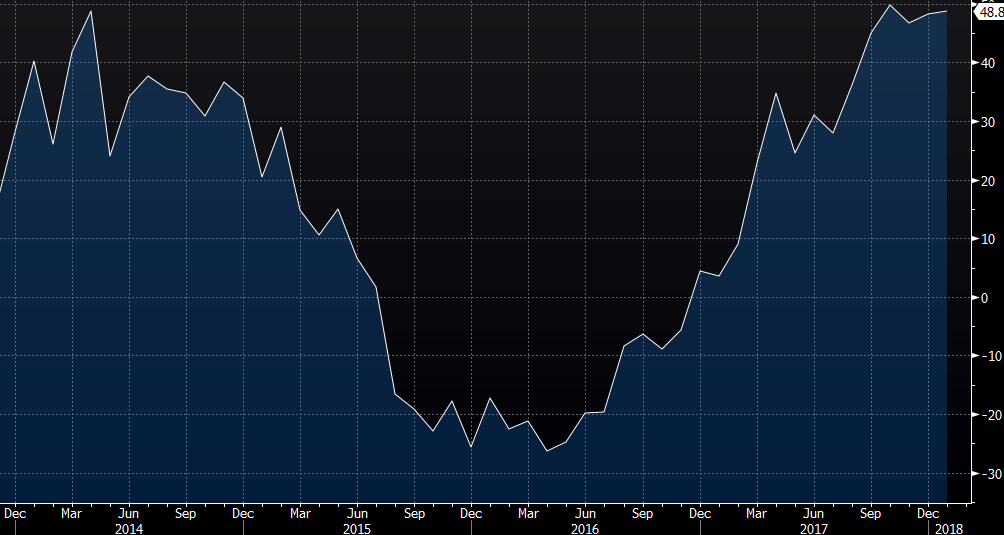

The big drop in December for this was a bit of a shock and disappointment. A bounce back, to a smaller extent, is expected in January. I like to keep an eye on the 'machine tool orders', which for January should a very solid 48% rise in January, and preliminary data for February are up nearly 40%:

which augurs well for the data today.

The bigger picture of the Japanese economy is becoming more mixed after indicators had earlier shown a good bit of recovery.

0110GMT - Bank of Japan Japanese Government Bond buying operation scheduled

- 1-3, 3-5, 5-10 years

0200 GMT - China data for February

It'll fall into the 'distorted by new year holidays' basket, and so for that reason the focus will be on combining the January and February figures, so watch the 'YTD' numbers:

- Industrial production YTD y/y expected is 6.2%, prior was 6.6%

- Fixed Assets (excluding rural) YTD y/y, expected is 7.0%, prior was 7.2%

- Retail Sales YTD y/y, expected is 9.8%, prior was 10.2%