There's a push from only one side in this cable move

Sometimes seeing what tail is wagging what dog is difficult, other times it's easy.

The move in GBPUSD is a pretty straight forward USD move. The evidence from other GBP pairs proves that. EURGBP up and GBPJPY down are two examples.

Is there any fundamental reason why the pound should be chirpy right now? Not really and that puts this GBPUSD rally at risk.

Some of that risk comes from the MPC meeting in just under two hours. I'm not expecting much from it and there's no real reason for any changes of tune from the MPC members but if they turn slightly more dovish then the pound might suffer further in the crosses.

As the dollar continues to get battered by all and sundry any dovish remarks from the BOE might put a dent in this rally. If it's a decent dent that could be a good opportunity to grab a dip long. I don't think this dollar pain is close to being over yet. I mentioned in the comments after the FOMC that an on hold and dovish Fed twinned with the BOJ with their heads in the sand is a bearish indicator to me.

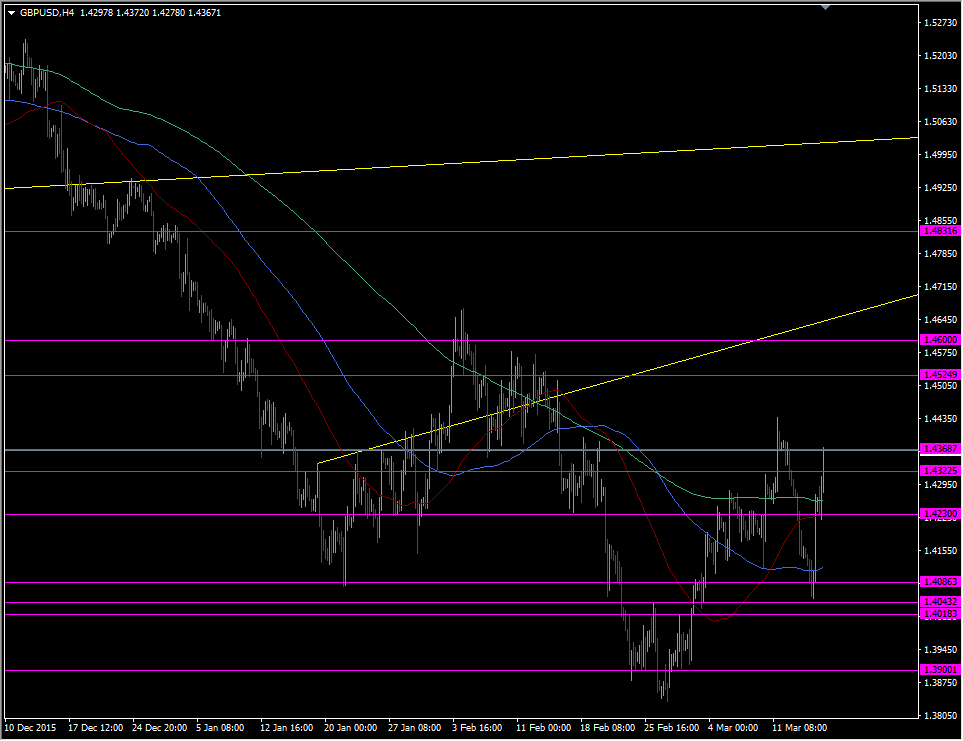

GBPUSD H4 chart

Up here we have resistance between 1.4370-90. I'm inclined to think that 1.4400 might be a natural halt point for what would a 350 pip rally since yesterday, so I'm interested in a big figure short if we test there before the BOE. However, I'll have one eye on how USDJPY performs at 111.00 as that might have a big say in the USD side of the trade.

I'm still long cable from lower down for the long term so this will be a quick play. Right now 1.4335/40 looks like it's trying to be support and we should see stronger at 1.4310 and then 1.4275.

GBPUSD 15m chart