Today’s comment from Japanese finance minister Azumi was a clever way to re-iterate something that’s included in every G7 statement yet it has boosted USD/JPY a half-cent. Reuters sources say Japan is highly unlikely to get consent to intervene from the G7 and no other leader mentioned the yen’s level.

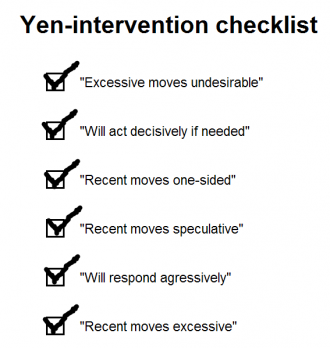

Still the market is worried about intervention because the MOF has now nearly-exhausted its verbal intervention checklist.

Nakao almost hit all those points on Friday and the rest have been spoken in the past three weeks. One thing we haven’t heard yet is that that MOF stands ready to take action. More (and explicit) rhetoric about the USD/JPY level not reflecting fundamentals would also be an incremental step.

My sense is that it would take a swift 150+ pip decline in USD/JPY or a fall below 76.00 to prompt the MOF to act. Action is also more likely at the end of the month.

USD/JPY technicals suggest 79.00 could be a difficult area to breach. The rebound in 10-year Treasury yields has also been shallow. As long as 79.00 holds, the bias in this pair remains lower.