Nearly retraced the week's earlier declines

Japan's Nikkei is having another bit day. After closing last Friday at 22819, the index fell to a low on Wednesday at 22119. Since then, there have been two gap openings higher, and the price high today has reached 22778 - nearly retracing the 700 point decline. We will see if the full loss can be recovered when the market reopens after the break.

The Topix index is also higher, rising by 0.8% at the morning close.

In other markets, a snapshot shows:

- The Shanghai composite index is trading near unchanged levels

- Hong Kong's Hang Seng index is up 131 points up 0.47%

- Australia's S&P/ASX indexes up 18.378 points or +0.31%

- Spot gold is higher by $2 or 0.16% despite a higher USD. Gold got hit hard yesterday, and perhaps we are seeing some profit taking before the weekend.

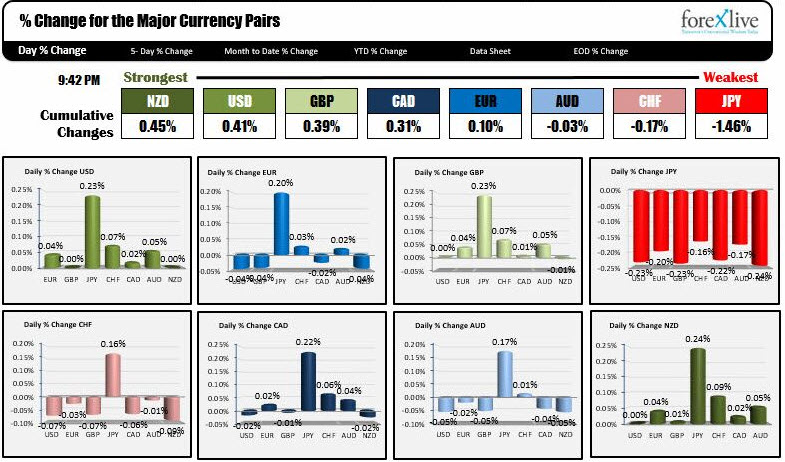

Looking at the % changes of the major currencies vs each other, the NZD is the strongest while the JPY is the weakest. The JPY pairs are the biggest movers with gains of 0.16% to 0.24% vs all the majors (see chart below). The JPY is ignoring what was much better than expected growth, and instead is following a flight out of risk path as stock markets are going better.

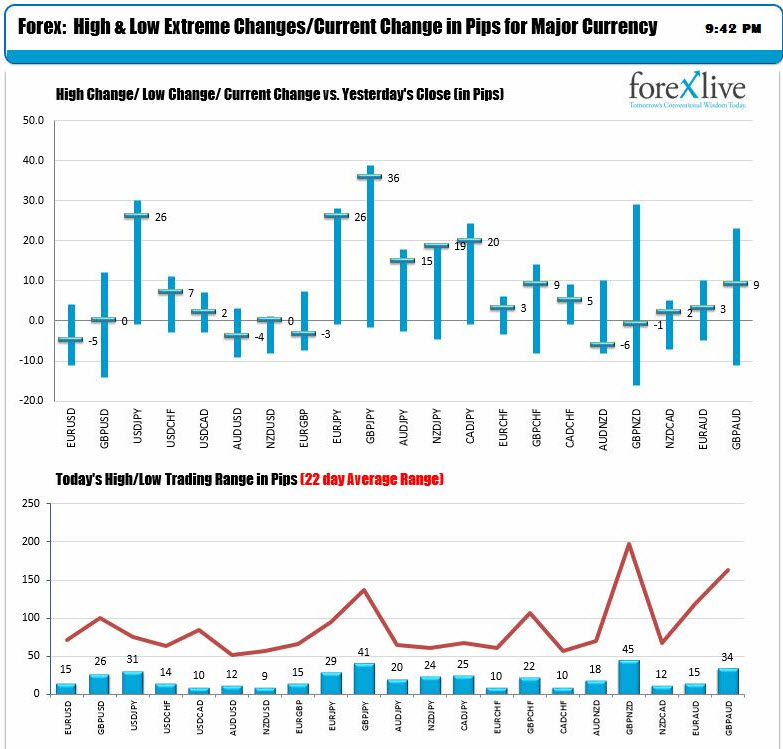

Looking at the changes and the ranges below, the JPY pairs are up the most, have the largest trading ranges and are trading near high levels.

Other pairs vs. the USD, are having more of a tough time. The NZDUSD has only a 9 pip trading range. The EURUSD at 15 pips is not much better. The GBPUSD has a 26 pip trading range but is trading unchanged on the day after moving up about 12 pips and down 14 pips at the extremes.

Later in the NY session the US employment report will likely get things moving.