Another throbber in FX land today and here’s a rundown on what’s hot and what’s not.

USD/JPY

Has unsurprisingly pulled up from it’s 25 odd pip rise from the overnight lows at the 200 dma. What was support yesterday is now resistance. Support at 101.45 overnight needs watching on a move back down.

With zip on the data front today, bar Canadian housing starts the risk event is the FOMC minutes later today. Unfortunately it’s unlikely to be a fireworks display but there’s a small risk that inflation may be touched upon in more detail than before, and that might give us a move.

EUR/USD

From looking like it might push higher through 1.3630 we’ve fallen back to 1.3602. The 55 h4 ma was too strong a tech level it seems but stronger tech at 1.3673/78 & 1.3685/89 will be the bigger focus up top.

Below, 1.3580/85 has come in as support again

GBP/USD

We made mincemeat of the 1.7094/100 level on yesterday’s manufacturing data but we’re finding support just ahead of the big figure once again. We’re up 6 pips from the low at 1.7106 with resistance at 1.7145/50

AUD/USD

I don’t really need to tell you what level this pair is flip flopping at do I? At the moment the 55 and 100 h4 ma’s at 0.9404 and 0.9396 are putting the squeeze on the range.

USD/CAD

1.0630 is support below the current price and there’s been good interest in keeping 1.07 protected.

Gold

Has gone back from whence it came yesterday. 1331 is the level to watch up top. Underneath we have a short term rising support line from June marking a series of higher lows. At today’s money that comes in at 1315.

Oil

Brent has come back into the pre-fear 108 range and there’s a strong S&R level at 108.32 with the former Feb 2013 resistance line at 108.78

102.00/20 marks an area of similar strong support in WTI

Looks like scalping is still the way to make money at the moment.

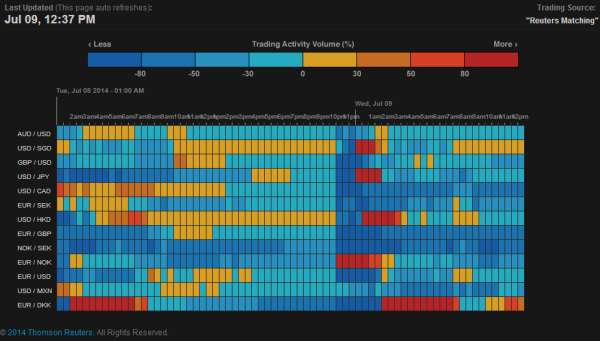

Reuters heat map 09 07 2013