I posted a preview of the Reserve Bank of Australia SOMP here earlier from NAB

And, other previews also:

- ANZ: RBA quarterly Statement on Monetary Policy due today - preview

- WPAC: RBA quarterly Statement on Monetary Policy due today - more preview

---

Just a bit more now from National Australia Bank on the RBA and Australian dollar:

Is the RBA likely to express discomfort at the recent AUD appreciation?

- From a valuation perspective we don't think so. Mechanically, the 4c AUD/USD appreciation since the Bank's last forecasts, on its own, point to downside risk to the growth and inflation numbers in (the) Statement on Monetary Policy. However, the global and domestic economic recovery are key offsets, tempering any ongoing RBA anxiety about the Australian dollar.

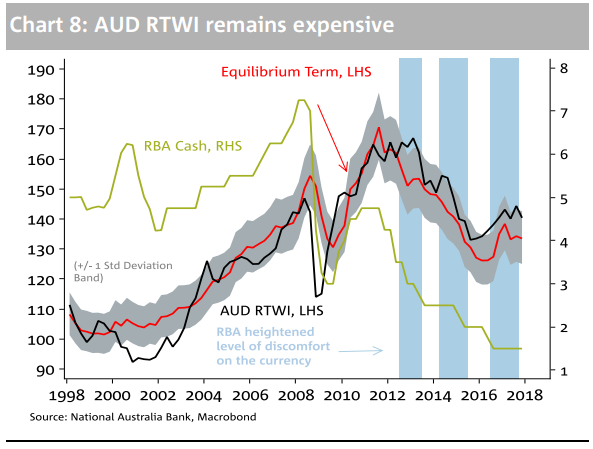

We have run NAB's replica of the RBA's preferred AUD RTWI model to the end of 2017. The model estimates an equilibrium level (red line in chart below) for the real TWI. Positive deviations from equilibrium (above 7%) have in the past prompted a change in RBA language on the currency. Sometimes these have been followed by rate cuts.

Because the model is based on quarterly data, we don't have all the inputs to calculate a ''live'' level, but since over short periods the AUD TWI and AUD RTWI shouldn't deviate materially, our 2018 year-to-date estimate suggests the overvaluation of the AUD RTWI has remained close to the levels seen at the end of 2017.

So, based on the model we think the RBA will remain alert to the currency's deviation from equilibrium, but not more so than before, arguably less given improving fundamentals.

Our analysis also shows that higher frequency variables (S&P, VIX, and CRB in the RBA's model) explain most of the current over valuation, further easing the RBA's concerns.