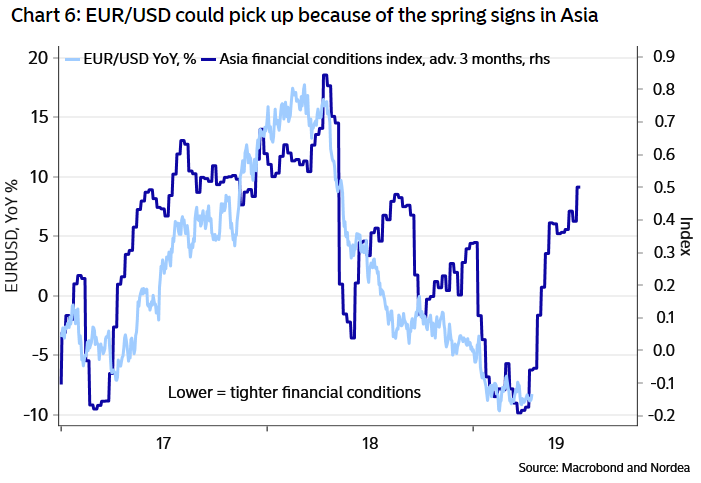

Citing 'have highlighted the green shoots globally for a while now', and we judge that an Asian rebound is better news for EUR than USD.

The bank going long euro against the US dollar (they note that in the long term they are not so bullish on EUR).

On the green shoots:

- combination of a triple-dovish Fed (QT, rates, inflation overshooting) … rise in oil prices has prompted a substantial drop in US real rates

- drop in US real rates have also helped beget more expansionary financial conditions in EM Asia

- upturn in Chinese monetary growth in March offers psychological support for the green shoots narrative.

Hence we go long EUR/USD

- Target 1.1650

- Consider a stop/loss 1.1187