Details of the November 2015 US CPI data report 15 December 2015

- Prior 0.2%

- 0.0% vs 0.0% exp m/m. Prior 0.2%

- Core 2.0% vs 2.0% exp y/y. Prior 1.9%

- 0.2% vs 0.2% exp m/m. Prior 0.2%

- Real weekly earnings -0.2% vs 0.0% exp m/m. Prior 0.2%. Revised to 0.4%

- 1.6% vs 2.1% prior y/y. Revised to 2.4%

The jump in the core will take most of the plaudits but the earnings number will be a worry, even more so with the better revision to Oct

The numbers have been worth around 16 pips to USDJPY which moved from 120.97 to 121.13

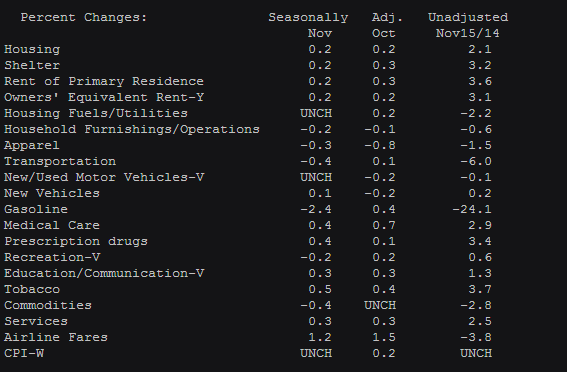

There's nothing really standout in the breakdown. Gasoline was the biggest move at -2.4% vs +0.4% prior and airfares rose 1.2% against 1.5% prior. Overall there's more components going the right way than the wrong way and that's what counts

US CPI & core y/y