The report is due at 2245GMT, I posted an earlier preive here

And, even earlier:

- New Zealand GDP expected to show a slowdown in a solid economy

- NZDUSD tries to keep a lid on the pair below "break" area.

This preview now via Westpac, bolding mine:

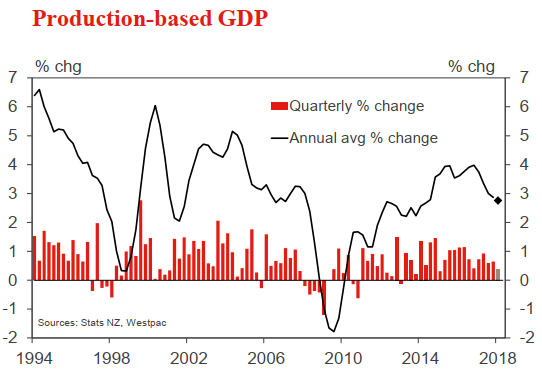

Following only modest growth in the December quarter, we expect that GDP growth softened again in March.

- We're forecasting only a 0.4% rise over the quarter. That would pull annual GDP growth down to 2.8%, which would be the slowest pace since 2014.

We expect the strongest growth to be in the public sector. We also expect a lift in agriculture, and a related lift in food manufacturing.

- However, a wide range of economic activity - such as transport, retail, wholesaling, and business and personal services - are expected to show weak growth at best, or even outright declines.

--

If you scan through the previews you'll note expectations are low, with downside risks cited. On the techs, NZD looks heavy. Makes sense given the indications we got in Jan-March, but just keep an eye out for any upside surprise which would give the kiwi a boost in the short term at least. Give shorts a better point to reload!