Q1 inflation data is due from NZ on Wednesday 17 April 2019, local.

- in GMT time 2245GMT on 16 April

Expected 0.3% q/q, prior 0.1%

- expected 1.7% y/y, prior 1.9%

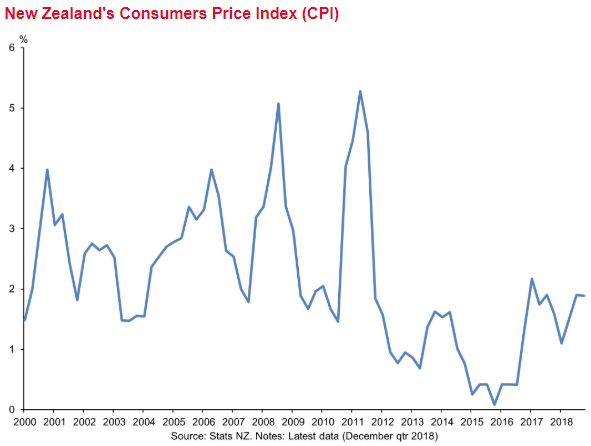

Like Australia, official inflation data from NZ is once a quarter only. Also, like Australia, the central bank is watching for signs (core) inflation will climb into the target area (although the RBA have been unconcerned about missing target on this, one of their two mandates, for a number of years now). whoops … back to NZ …

Preview via ASB:

- We expect overall consumer prices to rise 0.2% in the March quarter, lowering annual CPI inflation to 1.6%. Our forecasts are in a similar ballpark to those of the RBNZ and, although we are on the cusp of a quarterly 0.3% outturn (+1.7% yoy), risks appear broadly balanced.

- Abstracting from seasonal and transitory influences on the inflation process, we expect annual readings from the core inflation measures produced by Statistics NZ to oscillate around 2%, with annual inflation from the RBNZ sectoral factor model stuck below 2%.

- Our view is that downside risks to the inflation outlook have grown in recent months and the NZ economy looks increasingly unlikely to be able to generate sufficient economic momentum that will be able to keep inflation comfortably within the 1-3% CPI inflation band. However, we freely acknowledge the risk that this may take time to become readily apparent in the NZ inflation figures.

- We believe the RBNZ will grow increasingly concerned over the inflation outlook and will cut the OCR by 50bps over 2019. The exact timing on OCR moves remains fluid

Note that ASB mention the RBNZ sectoral factor model (measure of core inflation from the Bank). That data point will be published later the same day.