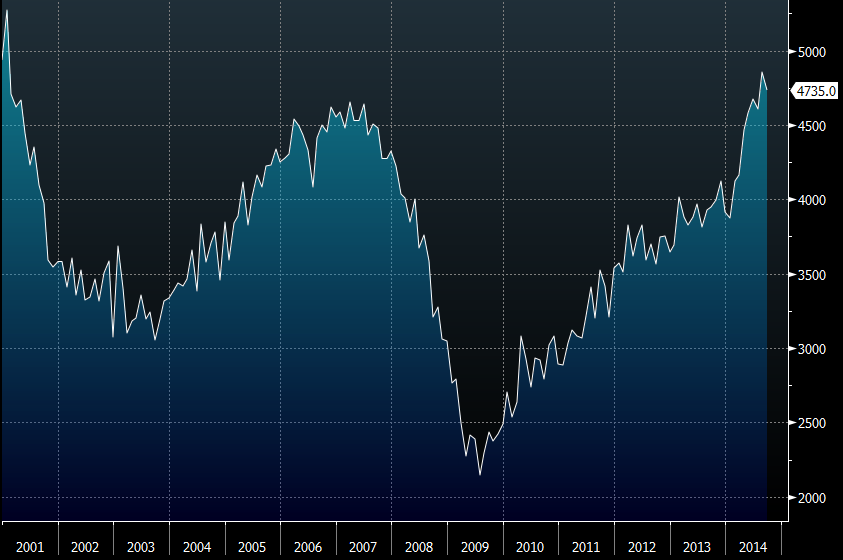

JOLTS near 13-year high

The highlight on the economic data calendar is the Fed’s Job Openings and Labor Turnover Survey (JOLTS) at 10 am ET (1500 GMT).

The Fed likes the report because it sees through the volatility and mixed signals of more headline-grabbing reports like non-farm payrolls. The main problem is that it’s laggy; it’s the second week of December and the report is for June.

JOLTS

The September report sagged to 4735K after hitting a 13-year high of 4853K in the August report. The consensus estimate is for a rebound to 4795K but it wouldn’t be a huge surprise to see a fresh 13-year high with estimates ranging from 4675K to 4880K.

Given the sour mood in markets, a strong JOLTS report is highly unlikely to turn around sentiment alone. At best, it could help stabilize the US dollar as it takes a swift fall — especially against the yen.

The report will be released alongside data on wholesale trade sales and IBD/TIPP optimism which are minor economic reports.