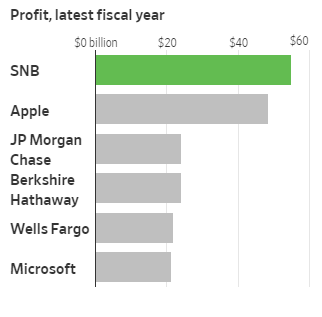

The expected CHF 54 billion exceeds that of even Apple

Yesterday, the SNB reported that they expect a record profit of CHF 54 billion (or USD 55 billion) for the year 2017.

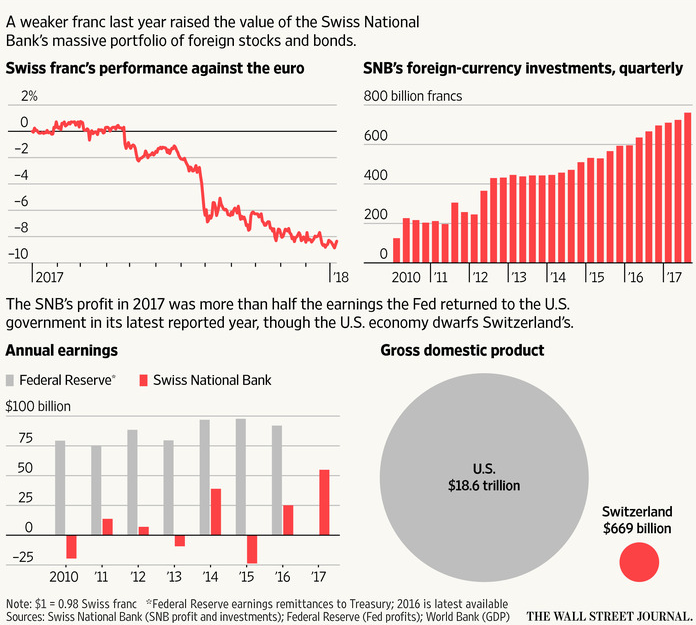

To shed some light into how much that actually is, the amount would be equivalent to 8% of Switzerland's GDP. By comparison, the Fed's annual profit in recent years have been around the region of USD 100 billion. If the Fed were to post an 8% profit relative to US GDP, its profit would come out to USD 1.5 trillion instead.

A WSJ report shows that the SNB's profits came from a trio of positive forces. First, being low bond yields preserving the value of its foreign bond holdings (which accounts to 80% of its foreign reserves). Second, higher stock prices boosted the SNB's equity holdings. And lastly, a weaker CHF made foreign assets held by the SNB more valuable.

The SNB's largest currency holding are euro-denominated assets, and the EUR/CHF strengthened by nearly 10% last year - which gave a massive boost to the SNB.

Here's how the SNB's (central bank which employs about 800 employees) profit stands in comparison to other major worldwide corporations:

Image source: Wall Street Journal