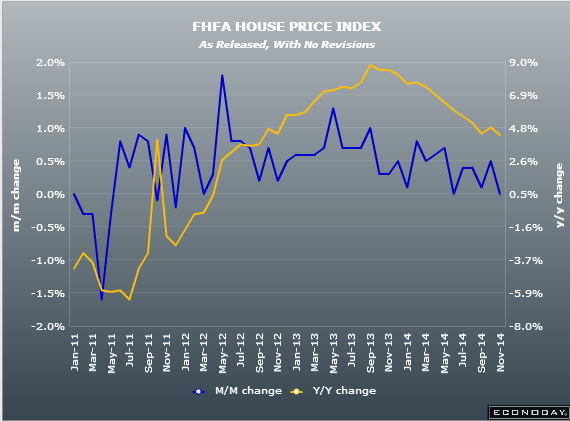

- Prior 0.5% prior

- 4.3% vs 3.9% prior y/y

- Index 214 vs 214 prior. Revised to 213.9

- Q3 price purchase index 1.0% vs 0.9% exp. Prior 0.8%

Prices continue to fall (both here and in the Case/Shiller numbers) and that will certainly relax the Fed that they’re not going to encounter any housing bubbles anytime soon, as long as it doesn’t turn into a rout because of any underlying problems.

US FHFA house price index 25 11 2014