The GBPUSD is marching higher, helped by the expectations of a No vote and favorable technicals as well.

Yesterday, I commented that the 100 and 200 hour MAs would be key over the next 24 hours (SEE POST). The market in the Asian session found support buyers against the level and the price has been able to stay above.

GBPUSD is above the 50% of the move down in September. Risk defining level now.

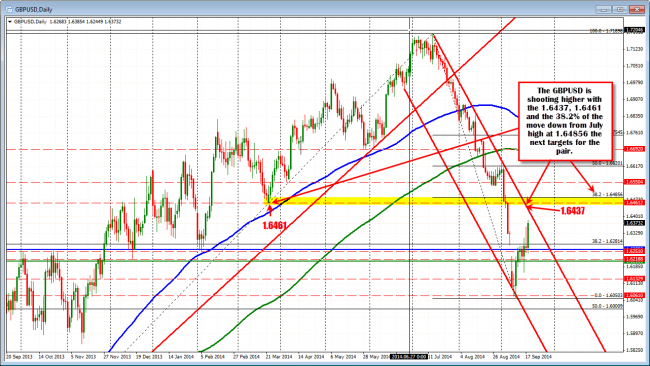

The next target to eye was the 50% of the move down from the September high. That level was broken in the last hour of trading. The bulls are taking more control as the fear from a “Yes” fades The next target is the 61.8% at the 1.64164 level and then 1.6437 which is channel trend line on the daily chart below. The levels are still in the distant but within sights if the bulls can remain in control.

GBPUSD daily chart targets 1.6437-85 now

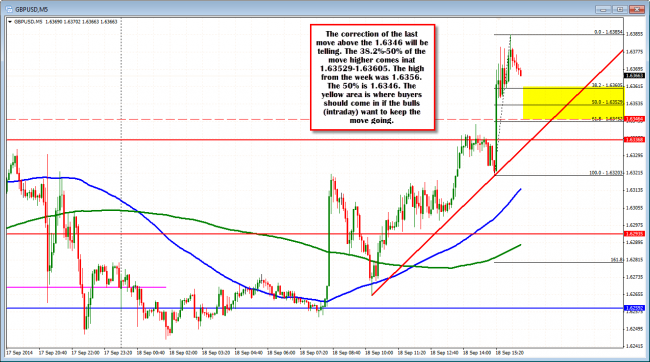

What is the risk now? IF the buyers are to remain in control. Look for the 1.63529-1.6360 to attract buyers. The 1.6356 was the high from this week prior to today. The 1.6346 is the 50% of the move down in September. The 38.2-50% of the last leg higher comes in at 1.6352-60. This area should find buyers. Putting it another way, if the price goes below the 1.6346 level, something else may be up (maybe it is just Scotland fear, but is not Scotland no fear which we are seeing now).

GBPUSD correction will be eyed for the support buyers. Risk down to 1.6346.