The Fed will deliver its first rate decision of the new year

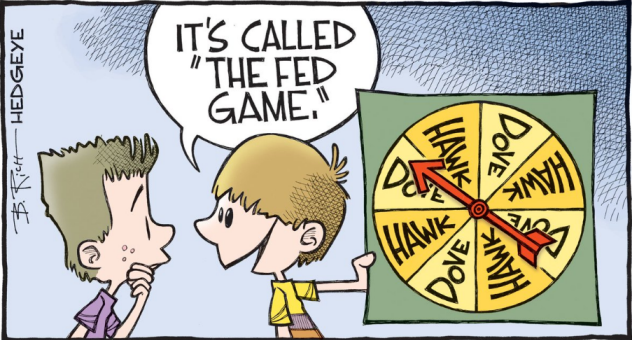

There is almost no doubt that the Fed will leave monetary policy unchanged later today and the statement is expected to repeat the language seen back in December.

The Fed should reaffirm "moderate growth" and the fact that the inflation outlook hasn't changed will continue to leave them alluding to be more data dependent.

Downside risks may have diminished as the US and China have finally managed to strike a trade deal but other risks have emerged in the mean time i.e. coronavirus outbreak.

Nonetheless, that shouldn't alter the Fed outlook this year all too much - especially with regards to inflation. As such, they should reaffirm that monetary policy is in "a good place" and that they stand ready to act if necessary to keep the economic expansion going.

So, what are the key highlights that we can look forward to instead?

Technical adjustment?

The Fed isn't going to be announcing a change to the Fed funds rate but some market participants are expecting the central bank to shift the IOER back up by 5 bps to 1.60% from the current 1.55%.

But this is largely seen as a technical adjustment to keep the effective Fed funds rate in-check and within the range of the current 1.50% to 1.75%.

Balance sheet talk

This is probably going to be the most interesting part of the Fed meeting today with Powell likely to face questions about the Fed performing "QE" with their recent purchases and if and when they will start to slow things down.

If the Fed is going to communicate something about the balance sheet growth slowing down at some point, then Powell's choice of wording with this regard may be a bit sensitive and if there will be any market reaction, I reckon it may possibly come from here.

Virus talk

I would expect Powell to be asked on the potential economic fallout from the new coronavirus outbreak but I would also expect him to keep a more prudent approach in answering that for the time being.

It is likely that he will say something along the lines of the situation being too early to judge and that the economic implications will still need time to be understood. I would expect him to reaffirm that the Fed is monitoring the developments closely as well.

As such, there shouldn't be much to gather on this topic from the Fed's perspective.

Summary

All things considered, the FOMC meeting today should be a relative non-event. But keep an eye for any potential surprises on wording in the statement as well as Fed chair Powell's take on the balance sheet.

Otherwise, the dollar and markets should have little to work with as the Fed kick starts 2020.