8 days to go as we look at the latest Brexit news

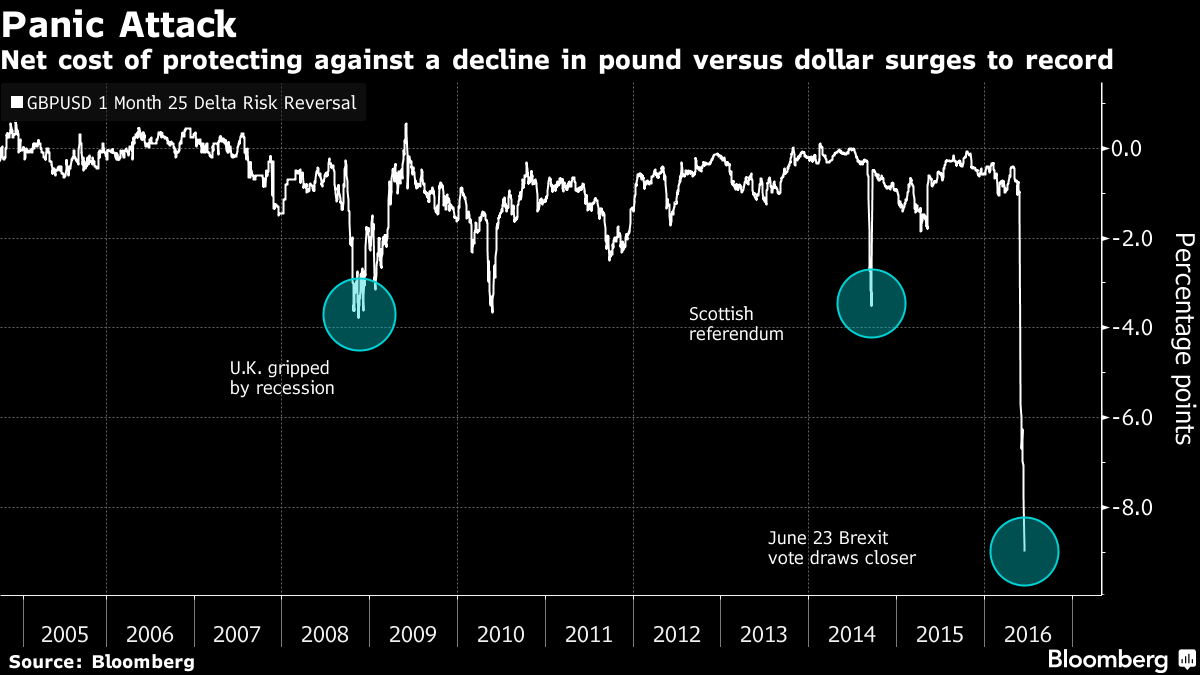

Bloomberg have noted that a staggering £25 billion has been placed on Brexit protection in GBPUSD. The amount has made the hedges over the general election, Scottish referendum and UK recession look like drops in the ocean.

The trades move into profit if cable drops to or below 1.35 after the vote. Of the £25bn places, £3.6bn has been placed this month so far. The increase in hedging has coincided with the balance swinging towards the leave side. People are still piling in even as the cost of such hedges soar to record highs across the board. Bloomberg's implied probabilities show a 38% chance cable will fall to 1.35 by the close of biz 23rd June, and a 26% chance of jumping to 1.50.

The biggest thing this tells us is that there is some very serious unwinding to come, whatever the outcome of the vote. It's also going to keep conditions volatile as more people hedge in the run up to the vote. It will be a two way street though as those who were in hedges early, and at cheaper levels, may take advantage of any latecomers running prices higher, to take some profit.

We've had more fun with the polls today and BMG is the mob in the headlines this time. Here's some of the latest headlines;

- BMG say latest poll results attributed to them are a hoax

- Latest Brexitpoll on wires: 41% Remain, 45% Leave (BMG poll)

- More Brexit referendum implications ... Calling the SNB's bluff on CHF strength

- Moron Osborne and his Brexit tax hikes

- Latest Brexit poll - Racing pigs predict the winner. Yes. Pigs in a running race.

- UK press (Times): Osborne to raise taxes if voters go for Brexit

- Latest Brexit poll - Sun newspaper reports Comres shows Remain with 1% lead

We have an idea of some of the next few polls to come (h/t LABC);

- 16/06 Ipsos Mori

- 16/06 Survation

- 18/06 Opinium

- 22/06 Ipsos Mori

I'm not 100% clear if these are poll dats or release dates. Ipsos have said that the 22nnd June poll will take place until 20.00 GMT and released 23rd.

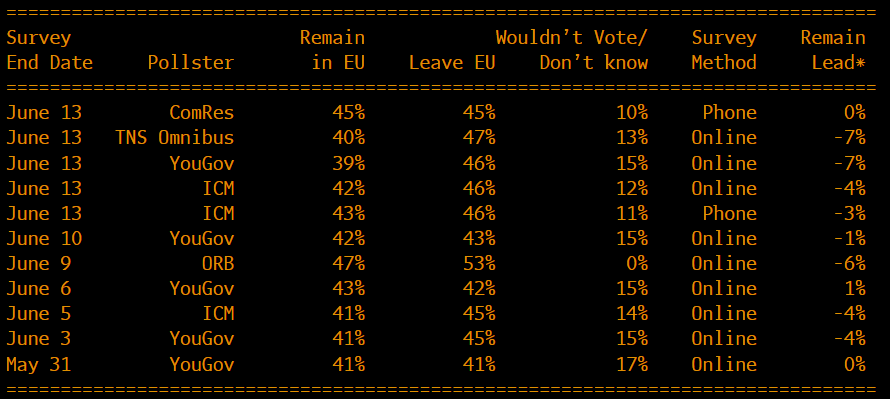

The results of polls monitored by Bloomberg are thus;

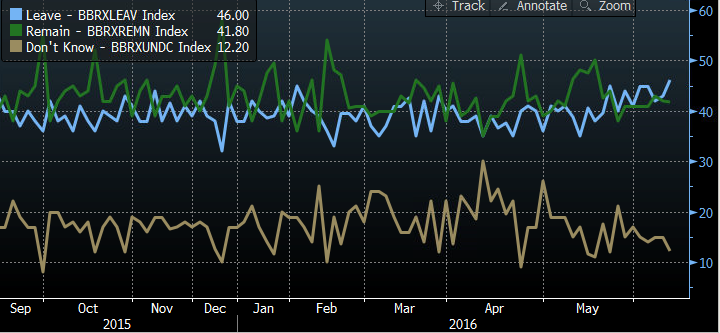

What the results mean for the leave/stay tracker;

The prior tracker had Leaves at 43%, stays at 42%, undecideds 15%.

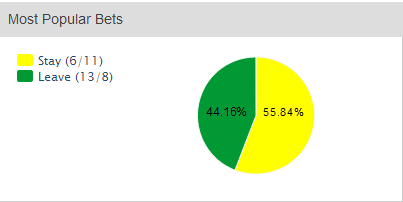

The odds are little changed at the bookies, more tinkering around the edges than any meaningful changes.

Brexit odds and where the money has gone.

I'd like to think we'll be able to concentrate on that little matter of the FOMC later but headlines will still run the pound around. Be especially wary of any big FOMC induced moves in GBPUSD, as that might give some of those hedgers better levels to hit.

Lot's still to come and learn about, and don't forget that you can join our live trading course which runs the week following the Brexit vote, which will no doubt feature highly during the week.

You can find details and sign up for it here