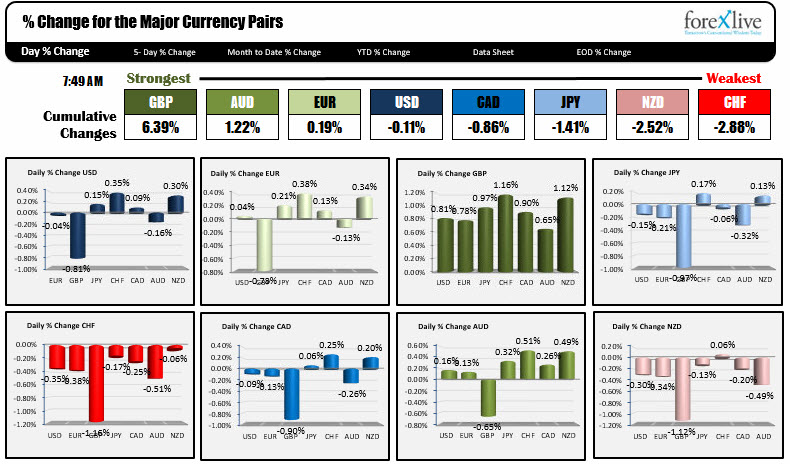

The snapshot of the strongest and weakest currencies as North American traders enter for the day - Sept 14, 2017

The GBP has raced to the top of the league table as the strongest currency after their statement that majority sees scope for stimulus reduction in coming months. The CHF is the weakest. SNB Jordan said they must continue its monetary policy and it repeats the CHF remains highly valued. N. Korea's comments that they will "sink" Japan and reduce the US to "ashes and darkness" have so far not led to a flight to safety.

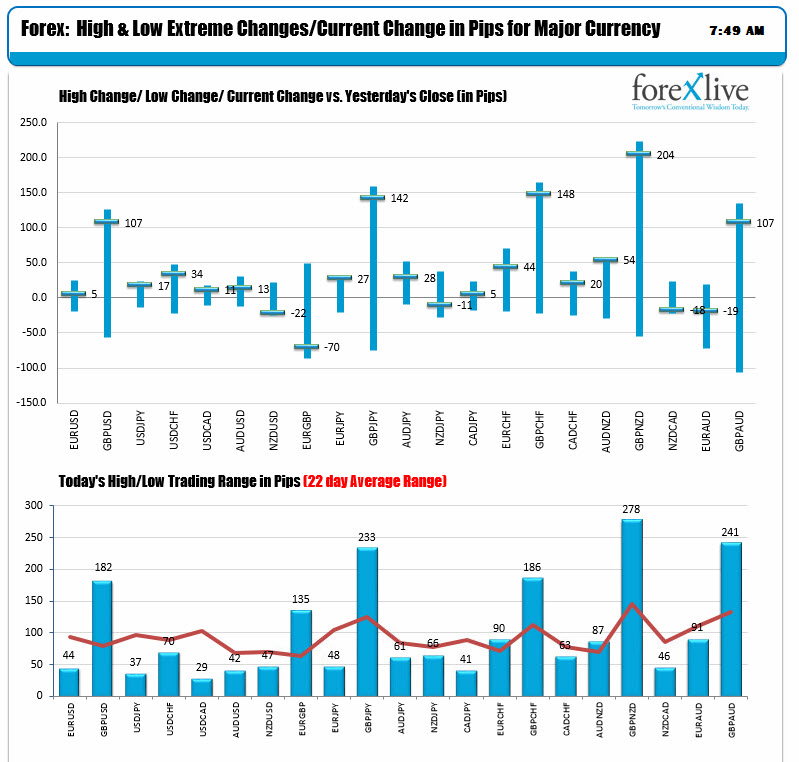

The ranges and changes are showing the action in the GBP pairs. That is where the action is. Those pairs are trading at high extremes as I type. The EURUSD at 44 pips. The USDJPY at 37 pips and USDCAD at 29 pips are examples of currencies that are not moving. Canada will release new housing price index, while the US will release CPI, and jobless claims (influenced by Harvey and Irma so it can be anything - be aware). Perhaps those releases will help give the pairs a push.

In other markets:

- Spot gold is down -$2.67 or -0.19% so it is not reacting to fresh N. Korea rhetoric

- WTI crude oil is up $0.60 to $49.90. The high is $49.92 so it is pushing the $50 level. It is above its 200 day MA at around the $49.54 level

- US treasury yields are higher with the 2 year at 1.3594%, up 1.2 bp. 5 year at 1.787%, up 2.0 bp. 10 year 2.2058%, up 1.7 bp. 30 year 2.8026%, up 1.6 bp

- The US stocks in pre-market trading are marginally lower. The S&P futures are down -2.25 points. The Nasdaq is down -10.75 points. The Dow is down -3 points.

- European 10 year yields are mostly up: Germany 0.413 bp 1.2 bp. France 0.700%, up 1.6 bp. UK 1.207%, up 6.2 bp. Spain 1.601%, up 2.1 bp. Italy 2.064%, up 2.4 bp, Portugal 2.813%, unchanged

- European major stock indices are mostly lower: German Dax -0.3%. France unchanged. UK FTSE -0.8%. Spain -0.5%. Italy +0.2%