Gold prices flat in April but turmoil elsewhere sets the stage for gains.

Volatility breeds contempt.

A steady uptrend or downtrend is a traders' best friend but erratic markets encourage traders to look for less-choppy waters elsewhere.

This year, currency volatility is extremely high. One-month FX options in the euro, pound, Canadian dollar, Australian dollar and Swiss franc have all risen to multi-year highs. The market can tolerate volatility in a trend. Despite the large moves in the foreign exchange market, the dominant theme has been US dollar strength.

GBPUSD 1-month atm volatility

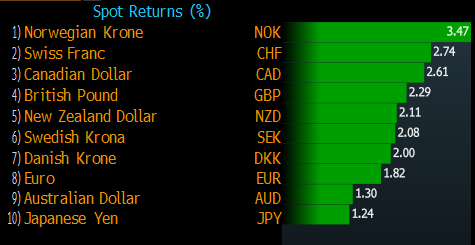

The USD may now be in a correction. A dollar slump this month accelerated in the past week and the currency lost more than 1% against every G10 currency and upwards of 3% against some rivals.

FX performance, week of April 17

Gold trading has been somewhat lackluster over the past three weeks as prices range between $1180 and $1220 but rather than a sign of complacency, that type of stability becomes beneficial as markets elsewhere are roiled. As volatility elsewhere rises, money will trickle into gold in the same way it did in the Nov-Dec 2014 period before surging nearly 10% at the start of the year.

A rise above $1220 will be a reason to for a renewed test of $1300 and perhaps beyond as the euro is severely devalued by QE and European investors look for a safe haven.

Looking ahead to Monday

Late on Friday, the Chinese government announced a crackdown on over-the-counter margin financing. It came after domestic markets were closed but sent foreign-listed ETFs down more than 5%. All eyes will be on Shanghai when trading reopens as the red-hot Chinese stock markets gets cooled off.

At this point, the curbs aren't enough to cause a any more than a blip in the bull market but if Chinese officials signal that they no longer wish to see stocks driven higher, it may encourage Chinese investors to shift to alternative assets like gold.