Don't get sucked into the wrong debate

Good news is often bad news.

If a central bank, like China, does something to stimulate the economy, that should be good news. There's no disputing that a rate cut is good news for the economy. It will certainly lower the cost of borrowing and help the economy.

But it's often interpreted as bad news because it means they're responding to something and that something might be a sharp drop in the economy.

So markets get worried.

In the case of China, I offered up both sides of the Chinese rate cut debate and I came down on the positive side. Morgan Stanley's head of marco strategy is on the other side.

The question everyone is asking is:

"How is the Chinese economy?"

Pundits are offering opinions on whether it's at the 6.9% official growth number, slightly lower, at 5-6%, or even worse.

Here's why that's the wrong question to ask: Because we're not going to figure out the answer. It's similar with other economies but China is so opaque and manipulative that the best we have to go on are things like internet traffic, rail traffic and movie box office receipts. Good luck with that.

The question we should be asking:

"How will market participants view the central bank move?"

What we're trying to judge is sentiment. It's not about what the economy is doing or isn't. What's more important for a trader is to determine how the economy is believed to be doing. In markets, perception is as important as reality.

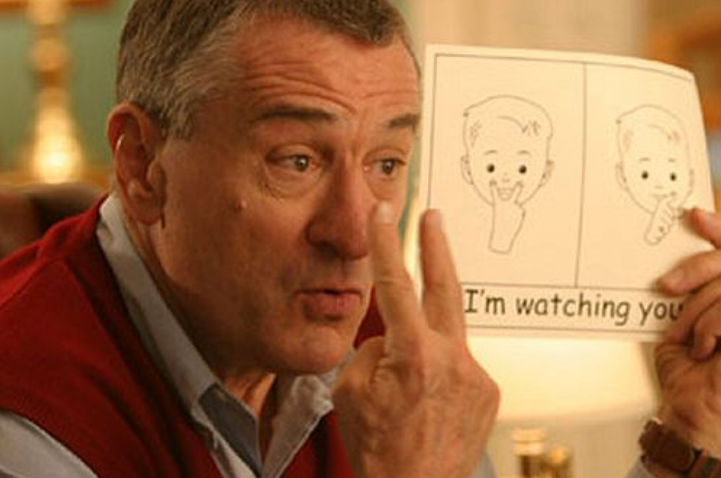

There's a metaphorical battle for the 'hearts and minds' of the men and women at trading desks. Your job as a trader isn't always to determine whether something is good or bad; it's to determine how the other guy views it.

Read everything about the news. Monitor twitter (and follow us). Try to get a sense of sentiment; it's as important as news, technicals or anything else.

Finally, please share your thoughts in the comments below.