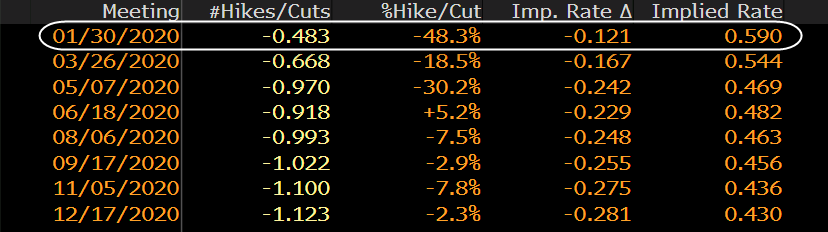

Odds of a 25 bps rate cut on 30 January falls below 50% from ~70% on Friday

The pound is pushing higher now as the rates market is suddenly beginning to be less convinced of a BOE rate cut next week. The pricing was still around ~57% less than a half-hour ago but it has dropped further as UK post-election data shows some optimism.

Essentially, this is also the market saying that they are leaning towards post-election PMI data to tip the scales towards no rate cut on 30 January.

Cable has now risen back above 1.3100 to session highs of 1.3120 and is challenging resistance from last week around 1.3118. If buyers can break above that, there is a good chance for the pound to run further towards 1.3150 next.

Ahead of the BOE next week, any rate pricing less than 70% odds tends to see the central bank not being forced into taking action but no doubt the meeting will still be a live one.

That is something to take into account in case the BOE does "surprise" with a rate cut.