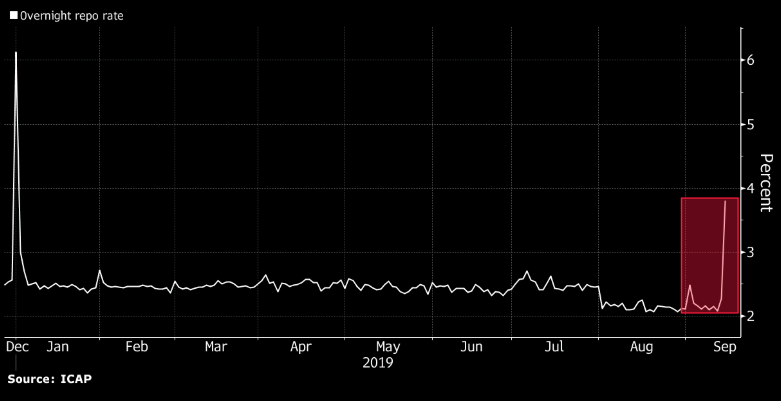

The repo market isn't healthy

The combination of corporate debt issuance and quarterly tax payments resulted in a shortage of dollars today. That pushed the borrowing rate on overnight repos up by 153 basis points to 3.80%.

A similar phenomenon took place last December and caused much hand-wringing (but ultimately little FX movement).

The timing of this move is particularly interesting because it comes ahead of the Fed decision. There will be some focus on the Fed funds effective rate today and whether it rises from the 2.14% level today. The FOMC targets 2.00-2.25% currently and there's talk that it's trading at 2.20%.

Today's move might have sparked some outright USD buying rather than borrowing among corporates and that could be what's weighing on EUR/USD.

Keep an eye on how it develops tomorrow.