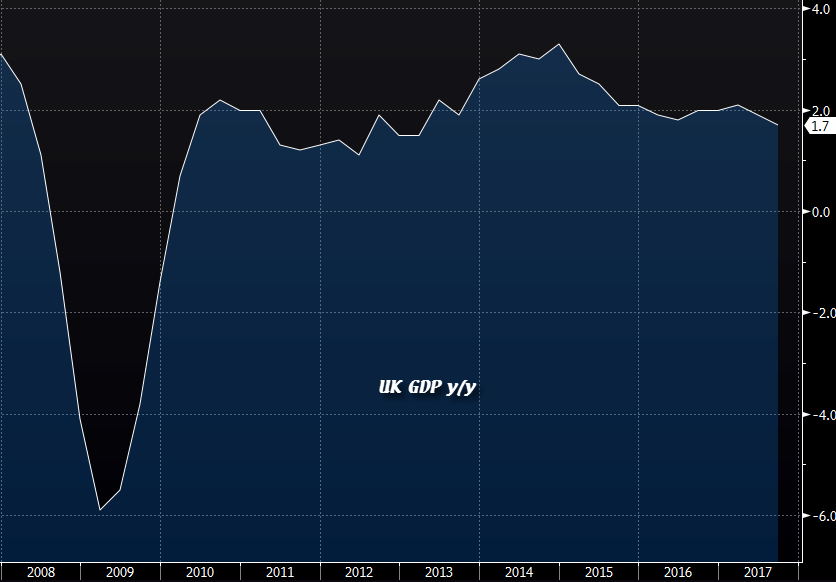

Latest data release by ONS on UK Q3 2017 final GDP

- Estimate/Revised readings were released last month here

- Final GDP y/y +1.7% vs +1.5% estimate

- Total business investment q/q +0.5% vs +0.2% estimate

- Total business investment y/y +1.7% vs +1.3% estimate

- Index of services Oct m/m +0.2% vs +0.1% expected

- Index of services Oct 3m/3m +0.3% vs +0.3% expected

- Q3 current account balance -GBP 22.8bn vs -GBP 21.4bn

- Prior current account balance -GBP 25.8bn

A beat on the year-on-year GDP reading, but as I mentioned not much reaction expected in the GBP market - and seems that way.

Business investment also came in higher than the revised reading, a little bit of a plus there.

Q3 current account deficit was higher than expected, but shrunk compared to the previous quarter after it was revised to a deficit of GBP 25.8bn from GBP 23.2bn.

Diving further into the GDP report, Q3 household spending was at +1.0% y/y - which represents the weakest increase since Q1 2012. And it shows that UK households have been net borrowers for the 4th straight quarter - the first time that has happened since they kept records in 1987.

GBP/USD at 1.3378 - barely moving from the report - after posting lows of 1.3360 earlier.