US April 2021 consumer price index highlights:

Prior was +2.6%

- Ex food and energy +3.0% y/y vs +2.3% expected

- Prior ex food and energy +1.6%

- CPI +0.8% m/m vs +0.2% expected

- Prior m/m reading was +0.6%

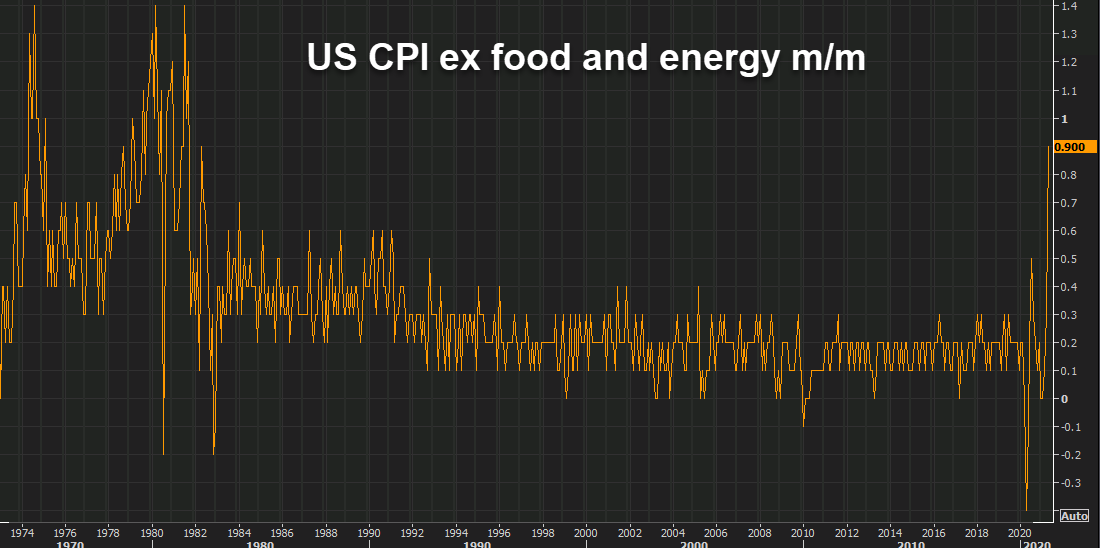

- CPI ex-food and energy +0.9% m/m vs +0.3% expected (highest since 1982)

Wage data:

- Real avg hourly earnings -3.7% vs +1.5% y/y prior

- Real avg weekly earnings -1.4% vs +3.9% y/y prior

- Full report

That's a big miss and the dollar is ripping higher. Everyone was expecting a bump because of base effects but this is truly a surprise and is going to test the FOMC resolve and the market's resolve to look through bottlenecks or temporary factors.

One big driver of the surprise was a 10.0% m/m rise in used car and truck prices, which is the largest in series history and single-handedly accounted for one-third of the rise. That made it a shockingly bad month to buy a car and is undoubtedly related to shortages.

It wasn't just that though as shelter rose 0.4%, transportation rose 2.9% (big jump in airfares at +10.2%), automotive insurance (2.5%), household furnishings (+0.9%) and apparel (0.3%) were factors.

Another factor for cars was the return of car rental companies. Normally they buy new cars but because of chip shortages, they haven't been able to find them. So they went out into the used markets and were price insensitive. Of course, big stimulus checks also arrived in March/April.