US October CPI data is due at 1330GMT, here are some broief points on what to watch from Nomura's preview

We are looking for a moderate increase of 0.167% m-o-m in headline CPI while the market consensus expects 0.2% m-o-m

- Although prices for motor fuels and electricity declined on a nonseasonally adjusted basis, we expect the aggregate energy price index of CPI to be essentially flat on the month on a seasonally adjusted basis.

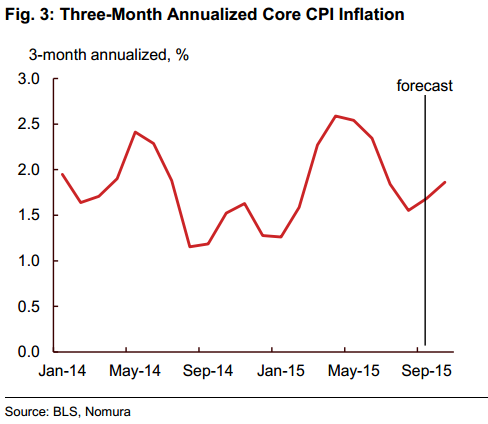

We forecast that core CPI, CPI excluding food and energy, rose by a trend-like pace in October

- Our forecast for core CPI inflation is +0.176% m-o-m, lower than the 0.211% advance in the previous month

- On core goods prices, although the recent stabilization of import prices for consumer goods in September and October poses some upside risks, we think that the lagged effect of lower import prices of both finished and intermediate goods continued to weigh on consumer goods prices. As a result, we expect a small decline of 0.03% m-o-m in core goods prices.

--

The big question, not touched on in this piece, is whether the CPI result will be enough for the Federal Reserve to proceed with a December rate hike ...

The Federal Reserve wants to be confident that inflation is moving back toward their 2% goal ... so far this hasn't been the case. This time for sure?