US dollar broadly lower in the aftermath

The market won't wait for confirmation that inflation will be transitory, instead it's already building in expectations that we've now seen the peak in year-over-year inflation.

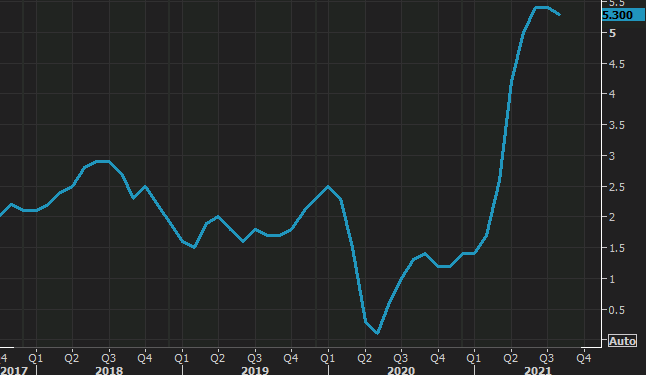

You can see the start of the crest clearly now in the year-over-year data:

As the Fed doves see more data that supports the ongoing turn lower, expect them to more-loudly and confidently call for patience in raising rates.

If that combines with a broader reflation trade and global acceleration (assuming we've also seen the worst of covid), then the stage is set for broader USD underperformance -- particularly against the commodity currencies.

At the moment, the dollar is on the lows of the day. An interesting chart is in GBP/USD, which is also getting a tailwind from a strong UK jobs report. The combination has pushed the pair through the September highs.

What has me worried in the broad inflation debate is the current second wind for energy prices via natural gas and power. That will threaten to keep inflation elevated at a higher level and frustrate consumers who may demand further wage increases.