US inflation numbers for July due at 1230GMT on Friday 10 August 2018

I posted up earlier:

A couple of others now, via

Barclays

- For the June CPI report, we forecast headline CPI to increase 0.1% m/m and 2.9% on a y/y basis.

- For core CPI, we forecast an increase of 0.2% m/m and 2.3% y/y.

- Core inflation has gradually picked up this year, as the drag from core goods has diminished and core services inflation has also ticked higher.

- We expect the US economy to continue to grow at an above-trend pace this year and the next, which should support utilization of spare capacity in the economy. This should lead to a modest overshoot of inflation above the Fed's 2% target.

Westpac

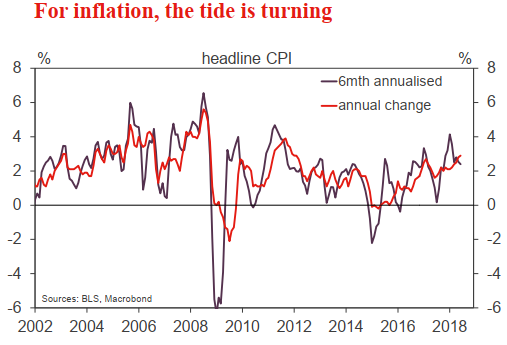

- Since February 2018, headline annual CPI inflation has been well in excess of the FOMC's 2.0%yr inflation target, having risen from 2.2%yr at February to 2.9%yr at June.

- While in part due to energy prices, core inflation (which exclude food and energy) also moved higher, from 1.8%yr to 2.3%yr.

- Shortening the time horizon assessed highlights why the FOMC has not been concerned by these well-above target outcomes. Notably, the six-month annualised pace has eased, from 3.6% to 2.4% for headline inflation and 2.5% to 2.3% for core. The three-month metric suggests a further deceleration will occur in coming months, but likely not quite yet.

- In July, a 0.2% gain is likely to instead hold up the annual rate.

- Looking further ahead, the extent to which CPI inflation holds to target will depend critically on the shelter component - a third of the basket. Private measures of rents are pointing to a material slowing, but this is yet to be seen in the CPI detail.

(bolding above is mine)