Two top-tier reports to come

The two releases of the week are due up next.

A big reason the Fed is thinking about cutting is that inflation has disappointed. The PCE report is their preferred measure and both the core and headline are forecast to rise 1.5%. If they're a couple ticks higher it could quickly change the narrative. The PCE report also contains valuable insights on personal income and spending that will highlight the state of the consumer.

PCE core y/y:

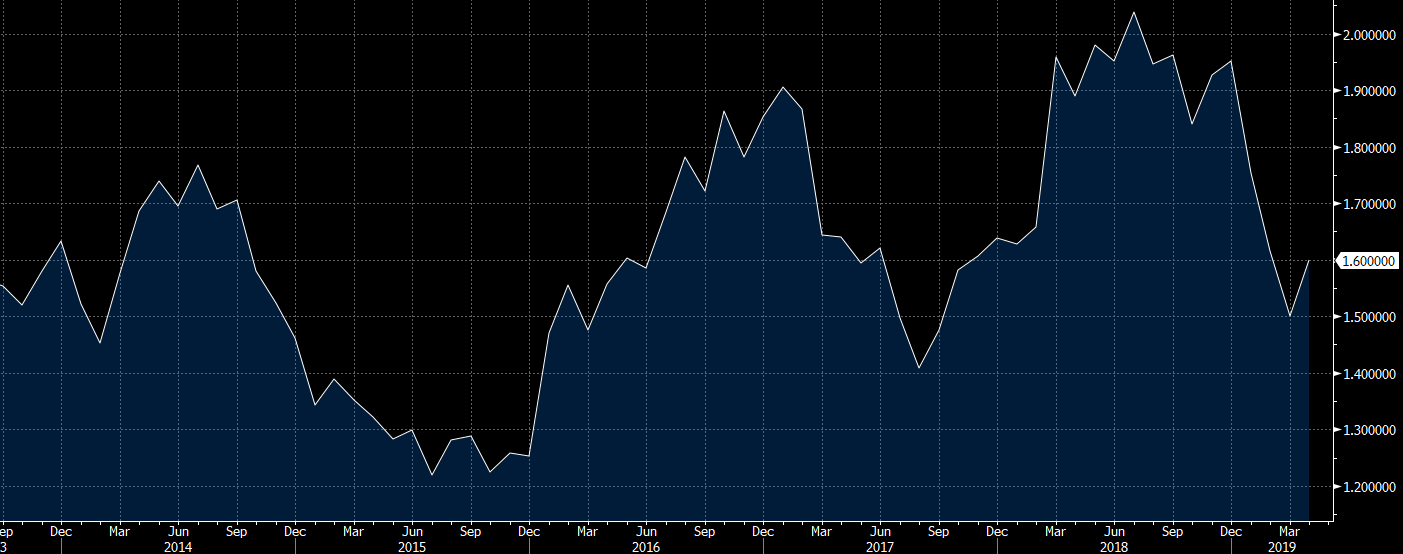

For Canada, the April monthly GDP report is due and forecast up 0.2% along with 1.6% y/y growth. After a few weak months, growth rose by a surprise 0.5% in March and the latest indicators have continued to impress. This week, wholesale sales were much stronger than expected and that points to a likelihood of an upside surprise. The Canadian dollar is a few pips away from the highs of the year.

Other news to watch today include the Chicago PMI, U Mich final June survey and dozens of G20 headlines and leaks. For more, see the economic calendar.