By Boris Schlossberg at BK Forex

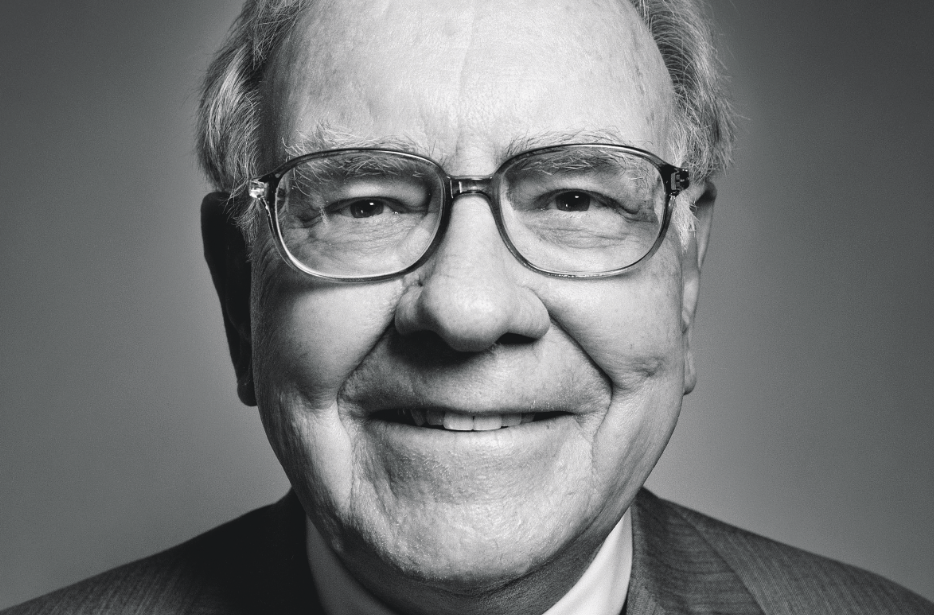

At first glance there seems to nothing common between Warren Buffett and the chaotic frenzy of the day-trading world that I inhabit. But on closer inspection I realized that there are some striking similarities between the way Mr. Buffett approaches investing and the way I look at trading every day. Both of us try to stay away from risk as much as possible.

The Gordon-Gekko-I-am-Master-of-the-Universe stereotype of Wall Street is actually not how true wealth is built."Have a hunch, bet a bunch" is not the the cornerstone of success of the great investors.

If you listen carefully to what Buffett says you realize that wealth is built by giving yourself a much bigger "margin for error" than most people think is necessary. In his latest letter to the shareholders, Buffett talks about the insurance business. He states that it is not enough to just understand the risks involved in the transaction and to price that risk correctly. To be truly successful in business you need to be able to walk away if the buyer of the policy isn't willing to pay your price.

This I think is the core secret for all trading and investing success. Simply put, Mr. Buffett's advice boils down to just two simple ideas -- know the full cost of your risk and don't chase price. When you look at the way Mr. Buffett invests it has very little to do with picking a great stock ( although he certainly tries to do his homework) and much more to do with picking a decent stock at a good price.

As investors and traders we all have our narratives for where the market will go. But if we are honest with ourselves we'll admit that no matter how much research we do, the accuracy of our forecasts is largely taken out of our hands. The world is too complex, developments happen faster or slower than we think and of course human beings are rarely rational and their behaviour is often bewilderingly unpredictable.Even if you are right you can be wrong.

A few months back you may have seen The Big Short. Christian Bale portrays Mike Burry who as one of the heroes of the film walks away with billions in profits by betting on the subprime crisis. Yet what is lost on almost everyone in the audience is the fact that Mr. Burry only won his bet by literally taking his investors money hostage. Although he was absolutely right in his investment thesis, the markets refused to move his way for a very long time. Meanwhile he was forced to pay premiums to keep his bets alive, which led to near term losses and calls by his investors to abandon the strategy. Had Mr. Burry not had the clause in his contract that allowed him to lock his investors money -- in short had he not had the "margin of error" to consider the absolute worst scenario -- his bets would have ended worthless and he would have been just another woudda-coudda-shoudda chump on Wall Street instead of becoming a celebrity investor.

What Mr. Buffett teaches is that we can only control two things -- the amount of risk we take on and the price we are willing to pay. One is intimately tied to the other. Mr. Buffett and I could not be more different. As a long term investor he trades time for money while as a short term trader I try to time my money and flip it over as fast as possible. But I'd to think that we both have a healthy respect for risk and more importantly the discipline to never chase price which hopefully puts me on the same road to financial success albeit via a different path.