It’s always good to have a balanced approach to trading and these two banks are on either side of the EUR/USD spectrum

Morgan Stanley are still gung-ho about their short positions and they cite the upcoming TLTRO’s for a continuation of falling peripheral bond yields as a reason to stay short.

“..falling peripheral yields should reduce the attractiveness of this asset class for non-bank investors. Investors will likely look for alternatives and, with cross-currency yield differentials widening in favor of non-EUR currencies, EUR should come under selling pressure”

They add that if volatility stays low then the euro will suffer mildly but a jump in vol will see the pair “sharply lower”

Credit Agricole are a little more cautions on the fate of the euro. While they don’t see it rocketing to the moon they do see a limited downside as rate expectations are unlikely to change for now. They say the jobs data was the main drive lower yesterday rather than European reasons but they don’t expect that data to have any meaningful impact on Fed policy expectations so further moves to the downside should be limited.

They also are holding/held short EUR/USD positions.

As usual, many thanks to EFX for the stories

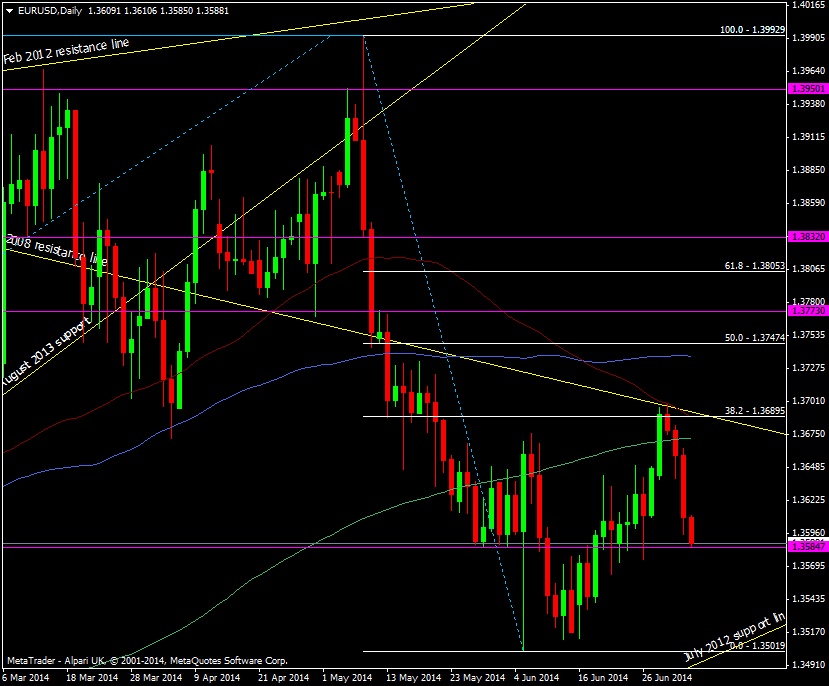

In today’s trading we’re down to the first line of strong support at 1.3585 and bumping along it at the moment. Unless we get a tapebomb, or someone going on a stop hunt or trying to take advantage of thin conditions we should hold the line until Europe clocks off.

EUR/USD daily chart 04 07 2014