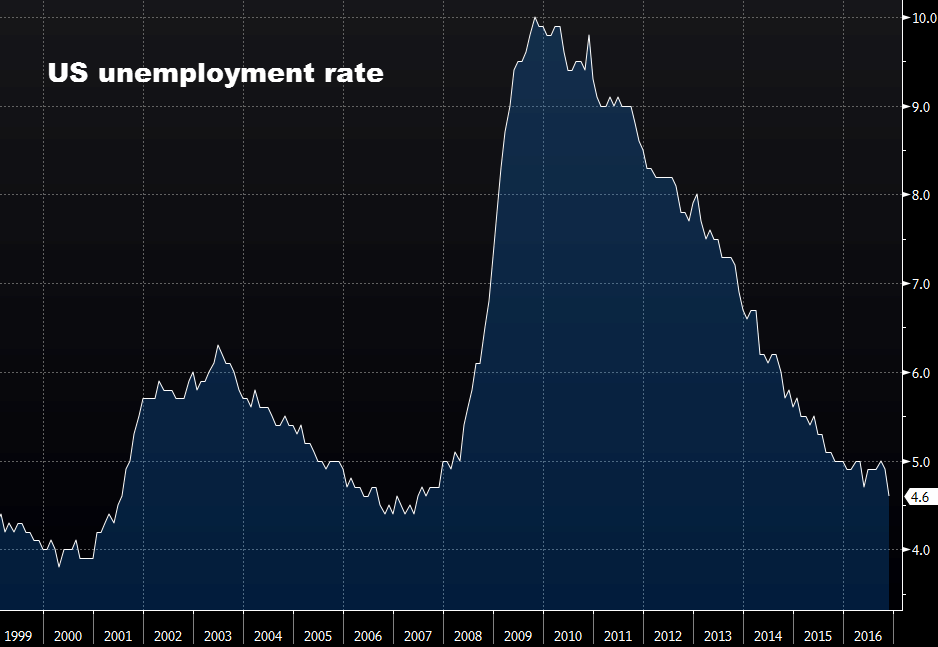

US dollar slips on soft wage growth despite lowest unemployment rate in nine years

The headline that will catch the attention of the US public in tomorrow's newspaper is that the unemployment rate tumbled to 4.6% from 4.9% in November. That's the lowest since September of 2007.

It sounds like the kind of news that would make the US dollar cheer but it didn't.

The problem is that the market, and the Fed, is increasingly fixed on the quality of jobs and the higher wages that go along with them.

The US economy simply isn't going to be prosperous if the only jobs being created are $10/hour services sector jobs and $15/hour manufacturing jobs. That sort of income is swallowed up instantly by the costs of food, rent and healthcare. In a consumer economy, there needs to be disposable income left over to spend.

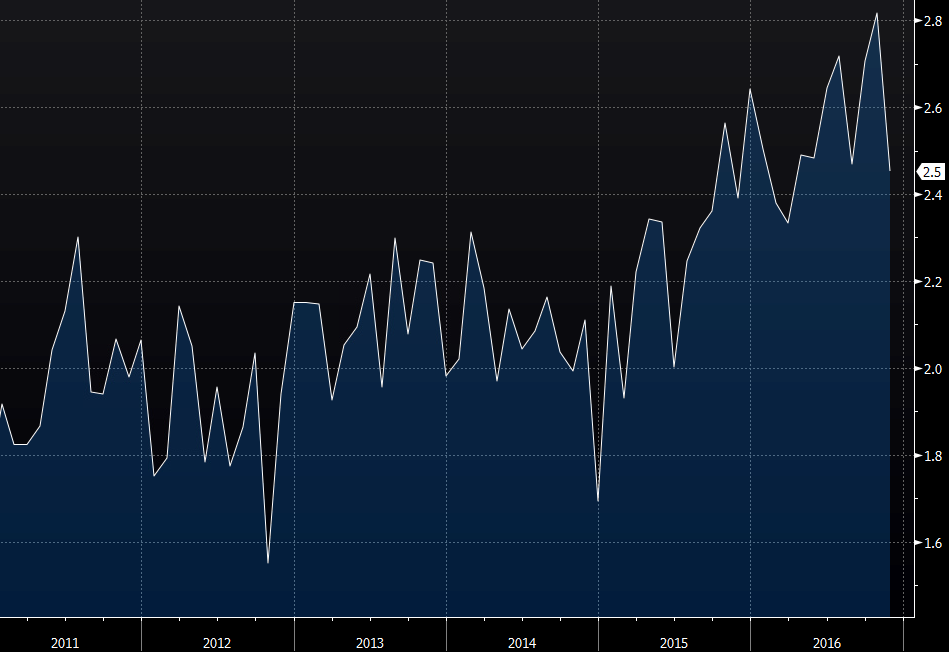

There are tentative signs that's coming but it took a step back in November. Average hourly earnings fell 0.1% in the month compared to a 0.2% rise expected. Wages are up 2.5% y/y, a slower pace than the 2.8% consensus forecast.

Still, the trend is clearly towards better wage growth.

That's good, but it's not quite good enough to convince the core of the Fed that wages will accelerate if they don't hike rates.

There is a nagging feeling at the Fed and on Wall Street that the US can create jobs but not good jobs. And that even if there is plenty of demand for work, that workers don't have any negotiating power.

Naturally, all those things change at the margins and the Fed doesn't want to get behind the curve. But don't expect Yellen to commit to a series of rate hikes until she feels more confident that wages are going up.