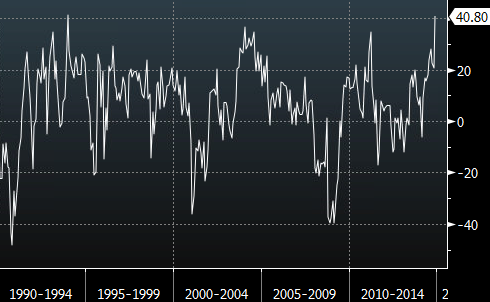

Last month’s Philadelphia manufacturing survey was a cracker. It came in at 40.8 vs 18.5 exp and the best reading since Dec 1993.

Philly Fed – 25 years

Everything rocked. The employment index nearly doubled, new orders did. It was a report that raised the eyebrows.

The Empire state and Markit PMI have made it 2 for 2 on worse readings so far for December and the Philly could make it a hat trick. Unsurprisingly the market is not getting carried away and expects a pull back to 27.0.

The dollar remains well bid after last nights FOMC and it’s going to take something big to shake that particular tree right now. Even if the Philly drops way below expectations then the market will just call last month a one off and will likely ignore it. If it comes in with a bumper number again the buck might respond and we could have the means to crack 119.

There’s loads of time before that release at 15.00 gmt and jobless claims are the next on the list today in around 10 minutes. “Steady as she goes” is the expectation as we look for 295k vs 294k prior. The four week average came in at 299.25 last month.