What's expected:

- Consensus estimate +180K (range +120 to +290K)

- Private +155K vs +164K prior

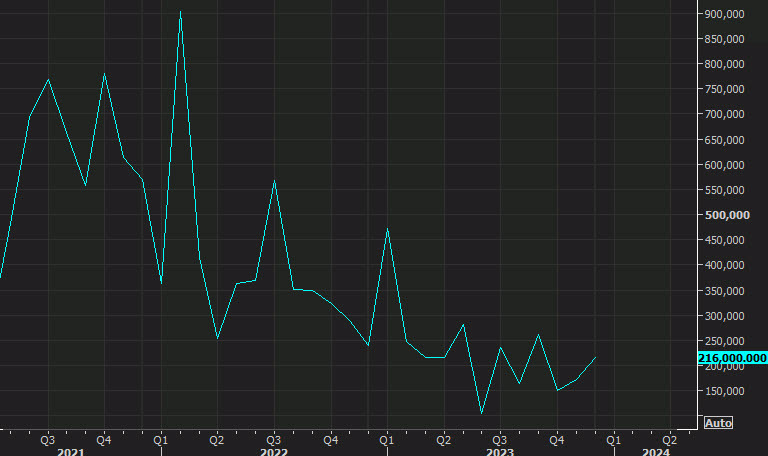

- November +216K

- Unemployment rate consensus estimate: 3.8% vs 3.7% prior

- Participation rate: 62.5% prior

- Prior underemployment U6 7.1%

- Avg hourly earnings y/y exp +4.1% y/y vs +4.1% prior

- Avg hourly earnings m/m exp +0.3% vs +0.4% prior

- Avg weekly hours exp 34.3 vs 34.3 prior

December jobs so far:

- ADP report +107K vs +150K expected and +158K prior

- ISM services employment not yet released

- ISM manufacturing employment 47.1 vs 47.5 prior

- Challenger Job Cuts 82,307 vs 34,817 -- 10-month high

- Philly employment +0.8 vs +4.0 prior

- Empire employment -6.9 vs -8.4 prior

- Initial jobless claims survey week 189K vs 2205K last month (was the lowest since Sept 2022)

On thing I will be watching for in this report is revisions. The two-month net revision in the November report was -71K and that followed a -35K revision in the prior report. There is a line of thinking that revisions tell you as much about the underlying economy as the headline, which can be volatile, especially in January which is subject to huge seasonal adjustments.

According to BMO, The headline payrolls print comes in below estimates 52% of the time and beats 48% of the time by 55k and 129k, respectively, on average. On the unemployment rate, 45% of previous unemployment reads in January have been lower-than-expected, 29% have been higher-than-estimates, and 26% have matched forecast.

vs